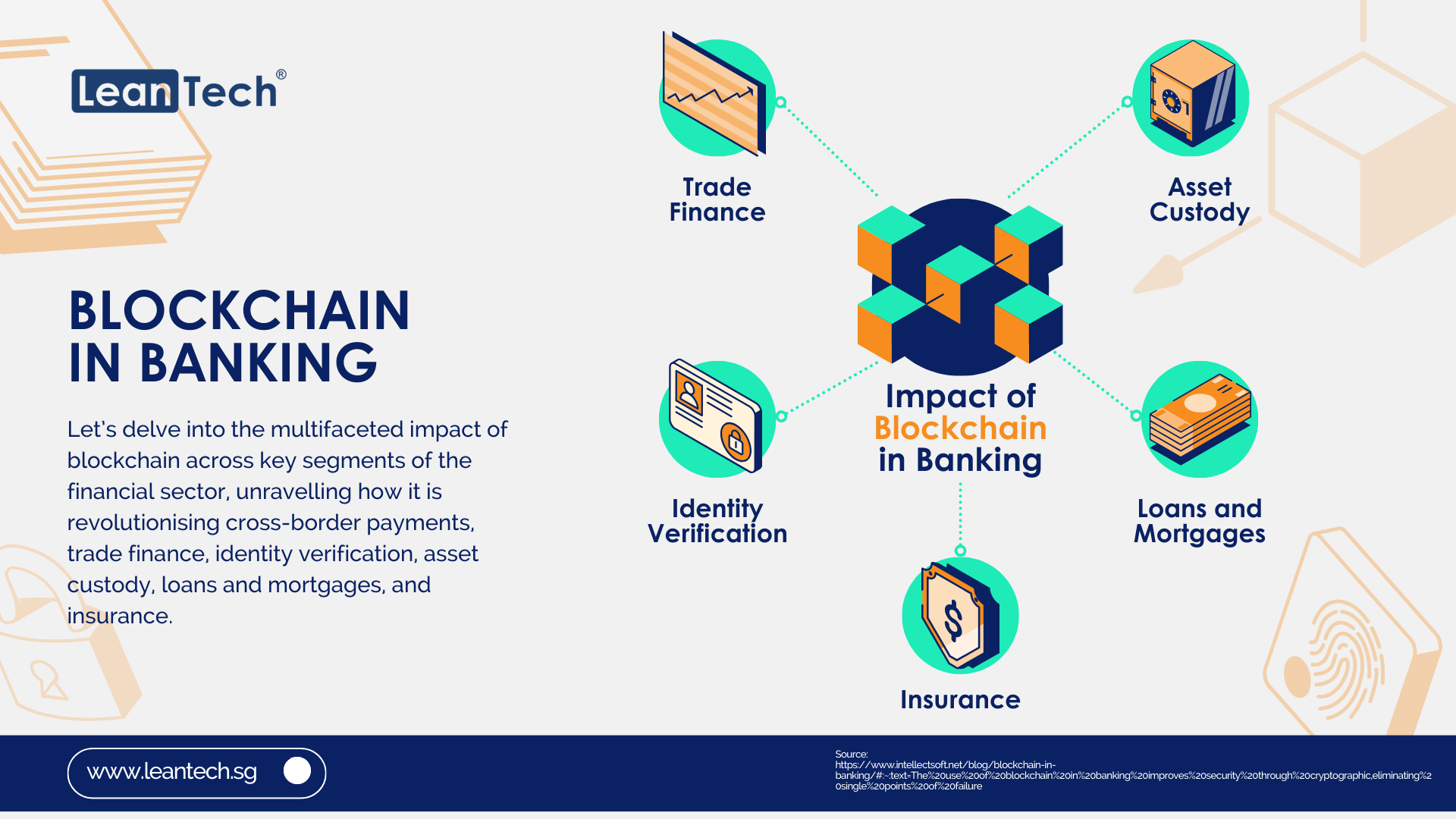

The ever-evolving landscape of the banking industry is experiencing a profound transformation with the integration of blockchain technology. Far beyond its origins in cryptocurrency, blockchain has emerged as a disruptive force, reshaping traditional banking processes. Let’s delve into the multifaceted impact of blockchain across key segments of the financial sector, unravelling how it is revolutionising cross-border payments, trade finance, identity verification, asset custody, loans and mortgages, and insurance.

As we navigate through each segment, the intricate ways in which blockchain is redefining established norms will become evident. From streamlining cross-border transactions to automating lending processes and enhancing the security of identity verification, blockchain is proving to be a catalyst for efficiency, transparency, and trust in the banking ecosystem.

Trade Finance: A Blockchain-driven Supply Chain Revolution

Blockchain introduces a transparent and immutable ledger to trade finance, addressing longstanding challenges in supply chain management. Every transaction and movement of goods is recorded on the blockchain, providing stakeholders with an unalterable record. This transparency minimises the risk of fraud and builds trust among participants in the supply chain. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate various trade finance processes. From verifying the receipt of goods to triggering payments based on predefined conditions, smart contracts streamline operations, reduce paperwork, and ensure that contractual obligations are met efficiently.

Identity Verification: A New Era of Security

Blockchain transforms identity verification by decentralising the storage and verification of personal information. Users have more control over their data, deciding what information to share and with whom. Decentralised identity systems reduce the risk of identity theft and unauthorised access, as the user retains ownership and authority over their personal data. The immutability of blockchain records enhances the trustworthiness of identity verification processes. Once an identity is verified and recorded on the blockchain, it becomes a permanent, tamper-resistant record. This feature ensures that the information remains accurate and trustworthy over time.

Asset Custody: Elevating Security Standards

Traditional asset custody relies on centralised institutions. Blockchain introduces decentralised asset management, allowing individuals to have direct control over their financial assets. Smart contracts on the blockchain can automate various aspects of asset management, providing a secure and transparent environment for investors. Blockchain enables the tokenisation of assets, breaking them into smaller, tradable units. This not only enhances liquidity but also allows for fractional ownership, opening up new investment opportunities. Tokenisation on the blockchain transforms how various financial assets are managed and traded.

Loans and Mortgages: Streamlined Processes, Reduced Friction

Blockchain automates and streamlines lending processes through smart contracts. These self-executing contracts enforce the terms of the loan agreement, automating tasks such as verification, disbursement, and repayment. The result is reduced paperwork, faster processing times, and a more efficient lending ecosystem. Blockchain ensures transparency in lending transactions by maintaining an immutable record of agreements. All stakeholders can access a transparent history of transactions, reducing the risk of disputes and providing a clear overview of the lending process.

Insurance: Transforming Claims Processing and Trust

Blockchain transforms claims processing in the insurance sector by providing a transparent and automated system. Smart contracts can be programmed to trigger claims payments automatically when predefined conditions are met, reducing the time and complexity associated with traditional claims processing. Blockchain’s immutable records enhance the management of insurance policies. Once policies are recorded on the blockchain, they become permanent and tamper-resistant. This feature ensures the accuracy and reliability of policy information, reducing the risk of errors and fraud in policy management.

Looking forward

In each segment, blockchain technology brings forth transformative changes. Whether it’s revolutionising cross-border payments, streamlining trade finance, securing identity verification, enhancing asset custody, automating lending processes, or transforming insurance, blockchain is reshaping the banking landscape. As the industry continues to adopt and adapt to these innovations, the potential for increased efficiency, transparency, and security becomes increasingly evident. The blockchain revolution in banking is not just a trend; it’s a fundamental shift towards a more robust and future-ready financial ecosystem.