In today’s fast-paced world, instant access to funds is becoming increasingly important. This is especially true for individuals and businesses alike who rely on quick and secure money transfers. Enter Push to Card (P2C), a payment method revolutionising the way we send and receive money globally.

What is Push to Card?

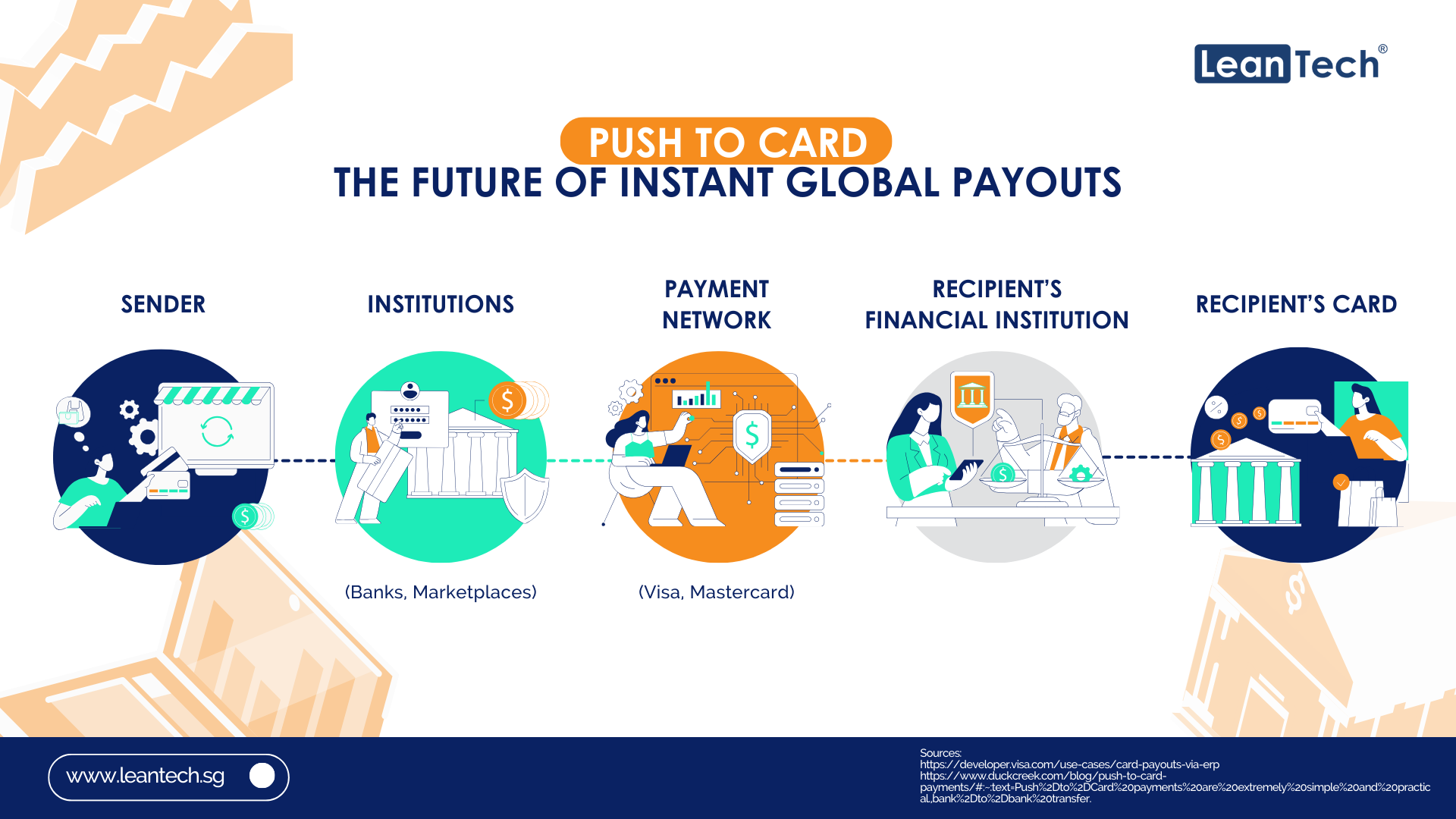

Unlike traditional pull payments where the payee initiates the transaction, P2C operates through a “push” system. The payer actively sends funds directly to the recipient’s debit or prepaid card. This method leverages existing card networks like Visa Direct and Mastercard Send, enabling near real-time transfers, typically within 30 minutes of authorisation.

This method is gaining popularity due to its convenience, speed, and accessibility, especially for those who are unbanked or underbanked. Additionally, it can be useful for businesses looking to streamline their payment processes and reduce administrative overhead associated with traditional banking transactions.

How Push to Card Facilitates Instant Global Payouts

Push-to-card (P2C) payments offer numerous advantages that make them an ideal choice for facilitating instant global payouts:

Speed: P2C transactions enable funds to be deposited directly onto the recipient’s card, eliminating the delays typical of traditional bank transfers. This is especially beneficial for international transactions, which often suffer from extended processing times.

Convenience: P2C transactions require only the recipient’s card details, simplifying the process for both senders and recipients. There’s no need for complicated account information or international banking details, making transactions smoother and more efficient.

Security: Leveraging the robust security protocols of established card networks, P2C transactions ensure safe and reliable transfers. This instils confidence in both parties involved in the transaction, reducing the risk of fraud or unauthorised access.

Applications of Push-to-Card for Global Payouts:

Peer-to-Peer (P2P) Payments: P2C allows for the instant transfer of funds between individuals globally, enabling friends and family members to send money to each other with ease.

Business-to-Consumer (B2C) Transactions: Businesses can utilise P2C for a variety of purposes, including issuing quick refunds, making payouts to freelancers or gig workers, and distributing rewards through loyalty programmes.

Disbursements: P2C is particularly useful for organisations such as insurance companies and governments. Insurance companies can efficiently send out claim payments, while governments can distribute social benefits directly to recipients’ cards, ensuring timely and secure delivery of funds.

P2C is not without limitations

While push-to-card (P2C) payments offer numerous benefits, including speed, convenience, and security, they also come with limitations. One significant limitation is the dependency on the recipient having a compatible debit card. This requirement excludes individuals who do not possess a debit card or whose cards are not supported by the P2C system. Additionally, P2C payments may incur fees, including transaction fees or currency conversion fees, which can vary depending on the service provider and the specific transaction details. Furthermore, while P2C transactions are typically faster than traditional bank transfers, they may still encounter delays in certain circumstances, such as during high transaction volumes or due to network disruptions.

The Future of Push to Card

As technology evolves and the demand for instant global payments continues to rise, P2C is expected to play an increasingly significant role. Its potential benefits extend beyond speed and convenience, fostering financial inclusion by providing access to secure and efficient payment options for a wider global audience.