In the ever-evolving landscape of finance, traditional banks are finding themselves at the crossroads of adaptation. The rise of fintech companies is reshaping the industry by offering more efficient, cost-effective, and personalised financial services. In this blog, we’ll delve into how fintechs are challenging banks across various fronts, from payments and lending to investment services, and explore the strategies traditional banks can employ to stay relevant in this digital era.

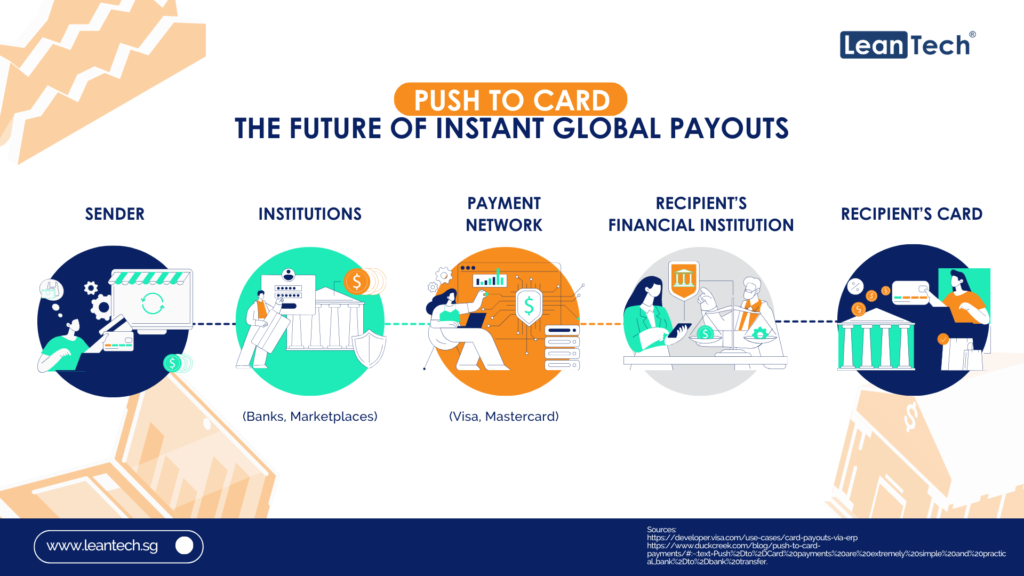

Fintech companies have emerged as game-changers, introducing streamlined processes and cutting-edge technologies that translate into increased efficiency. One of the key areas where traditional banks are feeling the heat is in the realm of payments. Fintechs are offering faster, more accessible, and cost-effective payment solutions, making the conventional banking model appear sluggish and expensive in comparison.

Inroads into Lending and Investment Services

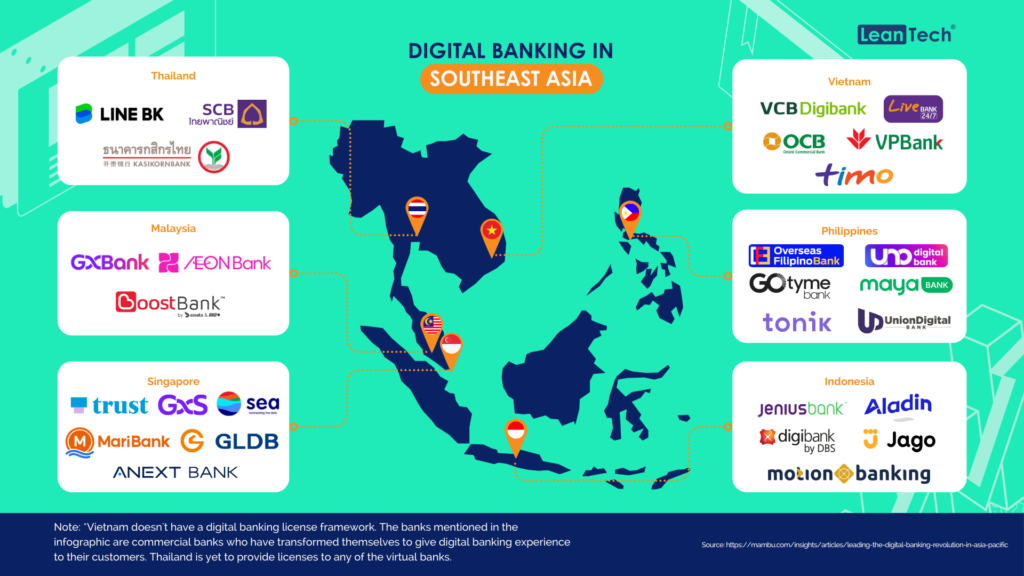

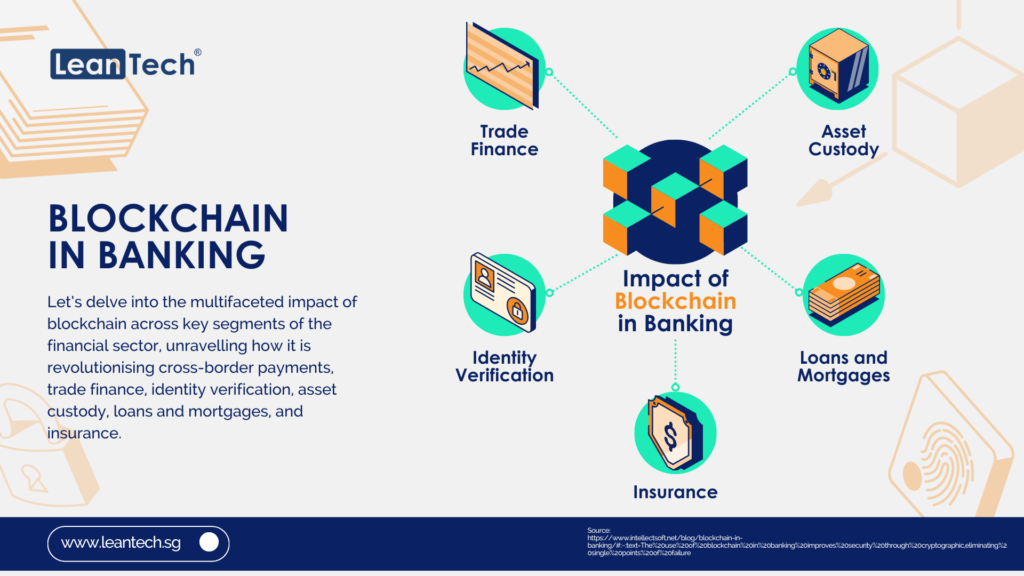

Beyond payments, fintechs are making significant inroads into traditionally bank-dominated territories like lending and investment services. By leveraging data analytics and innovative algorithms, fintech lenders can make quicker and more accurate credit decisions, challenging the lengthy approval processes of traditional banks. Similarly, investment services offered by fintechs are often more user-friendly, providing a seamless experience for users seeking to grow their wealth. The fintech advantage extends to lower fees and heightened convenience. Traditional banks, burdened by legacy systems and overhead costs, often struggle to compete on price. Fintech companies, unencumbered by such legacies, can pass on the cost savings to their customers, offering more attractive fee structures. Additionally, the convenience of accessing financial services through mobile apps and online platforms is reshaping consumer expectations, posing a challenge to brick-and-mortar banking.

Faced with this fintech onslaught, traditional banks are under immense pressure to innovate and adapt their business models. The challenge goes beyond mere survival; it’s a call to reinvent the way banking is done. The need for agility, responsiveness, and a customer-centric approach is pushing banks to explore new technologies and embrace digital transformation.

Adapting or partnering with Fintech

To stay in the game, banks are presented with two main strategies: adapt or partner. Adapting involves integrating fintech principles and technologies into their existing frameworks. This might mean overhauling outdated systems, embracing cloud computing, and adopting agile methodologies. On the other hand, strategic partnerships with fintech companies can provide banks with a shortcut to innovation, allowing them to leverage the strengths of both traditional banking and fintech innovation.

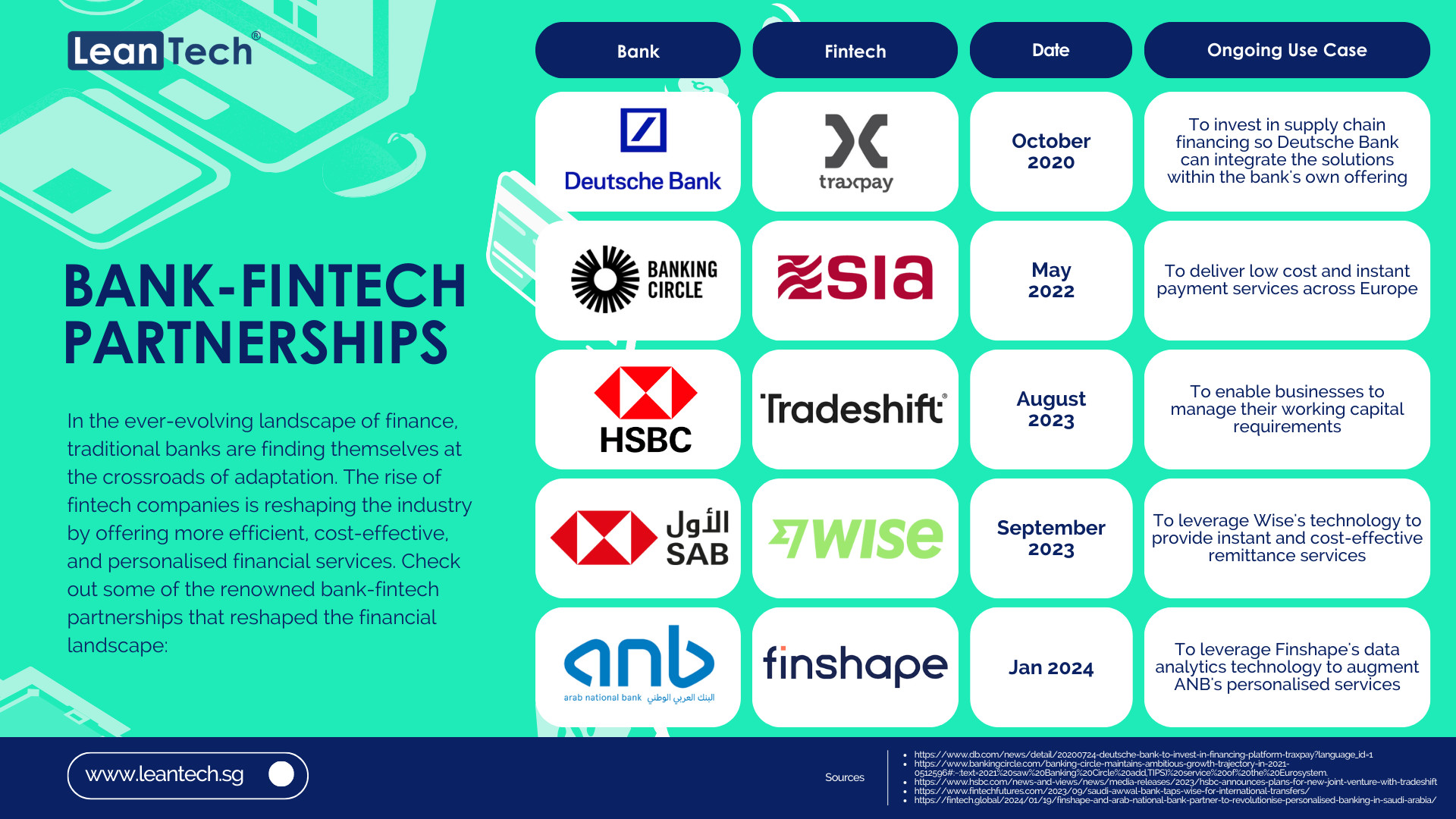

Check out some of the renowned bank-fintech partnerships that reshaped the financial landscape:

Way forward

The rise of fintech is not just a challenge for traditional banks; it’s an opportunity for a renaissance in the financial sector. The evolving landscape demands flexibility, innovation, and a commitment to customer-centricity. Whether through internal transformation or strategic collaboration, banks that recognise and embrace this paradigm shift are poised to thrive in the fintech revolution.