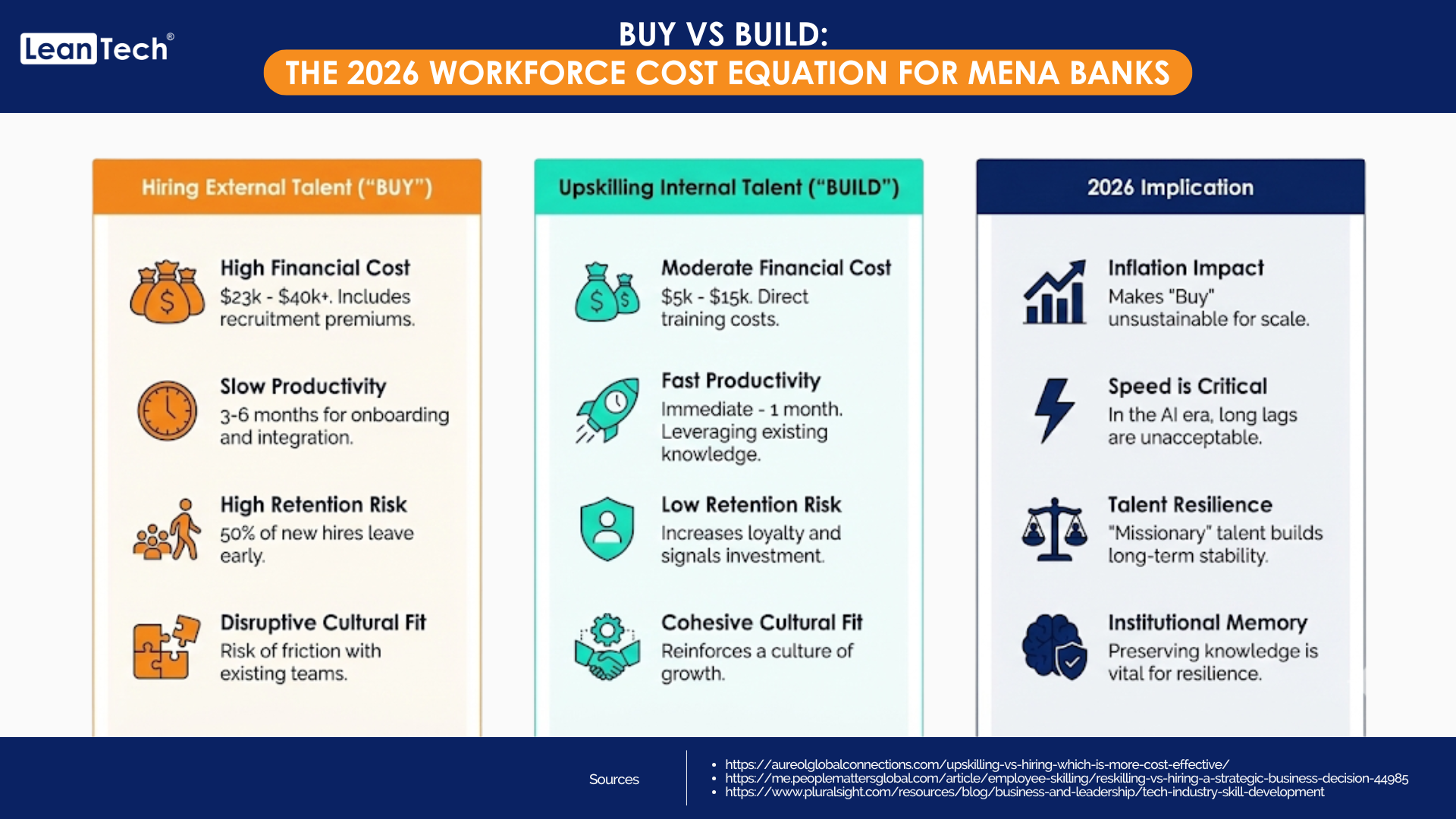

In 2026, MENA financial institutions are facing a critical economic question: should organizations hire new digital and technology talent (“Buy”), or should they retrain and redeploy existing workforce capabilities (“Build”)? The answer is increasingly decisive. Data across global and regional markets shows that “Build” is not only strategically superior, but financially unavoidable.

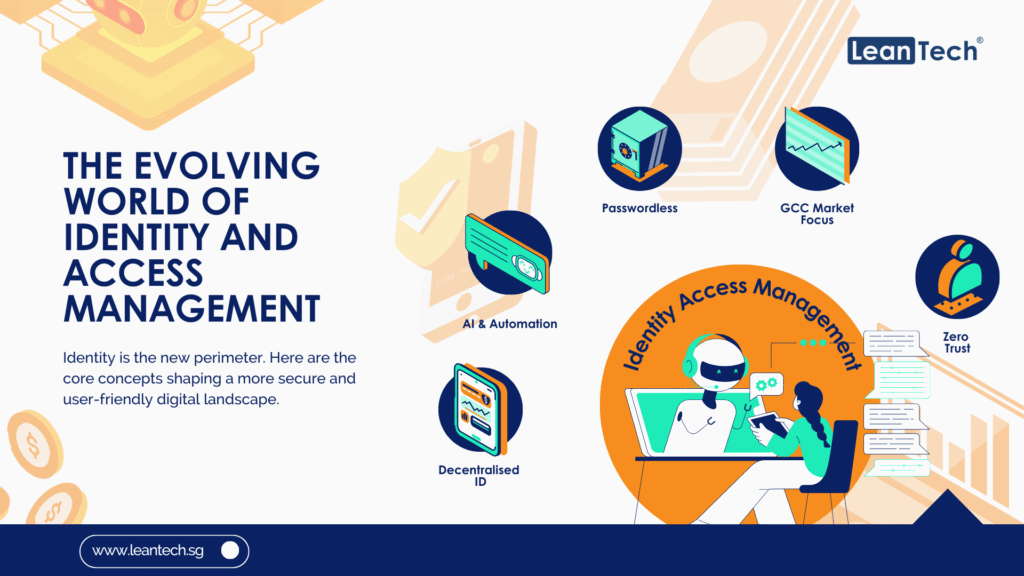

Organisations pursuing digital transformation in core banking modernisation, data, and cybersecurity no longer have the luxury of talent redundancy. The decisive variable is cost, followed by velocity, followed by institutional context and operational continuity.

The Macro Economics of Upskilling

The cost of hiring new technical talent has accelerated due to inflation, global remote talent mobility, and compensation premiums for scarce specialised skills.

Cost of Hiring: The global blended cost to hire a new technical professional averages $23,450 per head. This includes recruitment fees, advertising, HR screening, interviewing time, onboarding labor, and signing bonuses. In the MENA region, this cost profile increases further due to expatriate packages that commonly include housing, schooling and relocation allowances, which elevate total cost of acquisition.

Cost of Upskilling: By contrast, the average cost of retraining or upskilling an existing employee for an IT or digital role is far less. Organisations that deploy structured enterprise learning programs report even lower spend, with 57 percent indicating sub-USD 5,000 per head for training.

The savings differential is significant: more than USD 8,000 per role in direct costs, with substantially greater savings in indirect and operational productivity.

The Operational Risk of “Buying Talent”

Budgetary impact is only the surface layer of the dilemma. The “Buy” strategy carries structural dependencies and execution risk.

-

Wage Inflation without Net Skill Creation

Talent poaching between GCC banks has become a zero-sum game. The region’s aggregate skill pool does not increase; compensation packages simply rise. The net effect is inflationary pressure without transformational capability gain.

-

Project Delay and Delivery Bottlenecks

Sixty-six percent of organizations report that hiring takes longer than upskilling. Digital programs that rely on external recruitment face delays, idle project timelines and prolonged vacancy risks.

-

The Experience Gap

External hires often possess technical skills but lack internal institutional knowledge. A Python engineer without awareness of a bank’s legacy core architecture is less operationally effective than an internal analyst who acquires Python and already understands compliance workflows, batch constraints, or mainframe integration patterns.

Why “Build” is Becoming the Default Strategy

Three structural drivers are forcing MENA institutions toward “Build” as default strategy:

- Economic Efficiency: The upskilling ROI is concrete and measurable.

- Organizational Continuity: Retrained employees already understand compliance, risk and process.

- Talent Retention: Internal mobility reduces attrition during digital transformation.

This shift aligns with global digital workforce strategies that treat training as capital expenditure supporting productivity and resilience rather than discretionary HR cost.

Where LeanTech Fits into the Equation

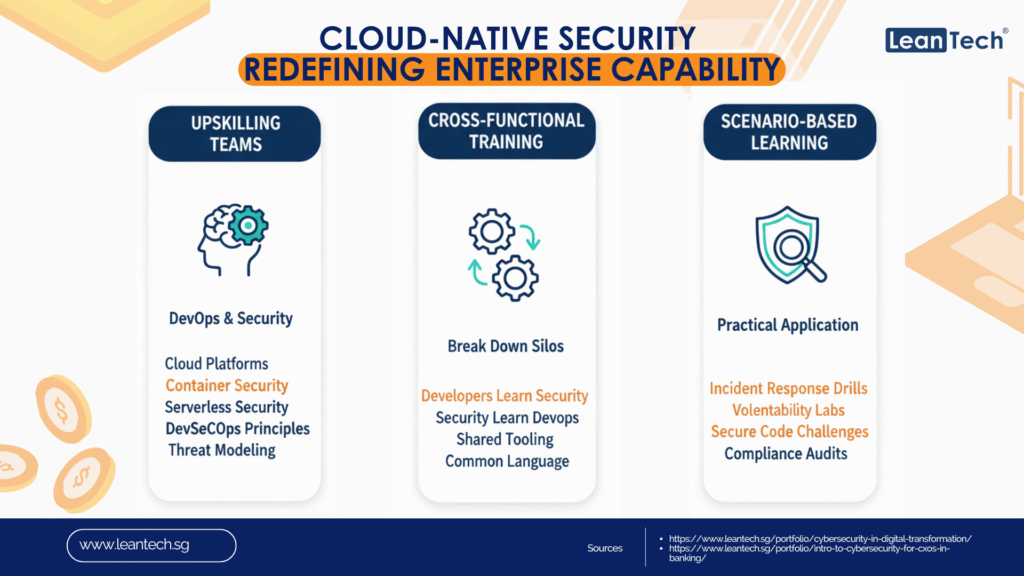

The “Build” strategy only functions if organisations possess structured capability-building systems. LeanTech’s capability academies and reskilling solutions operationalize this model across data, AI, product, DevOps and cloud domains. Financial institutions utilise these programs to:

- Reduce hiring dependency for hard-to-fill digital roles

- Redeploy internal workforce into revenue-aligned initiatives

- Shorten transformation timelines by reducing talent lead times

- Embed job-ready digital skills into existing operating models

LeanTech’s approach emphasizes competency mapping, role alignment, applied learning, and supervised transition into production workloads, enabling banks to create sustainable digital talent benches without inflating OPEX through repetitive external recruitment.

Strategic Implications for 2026–2028

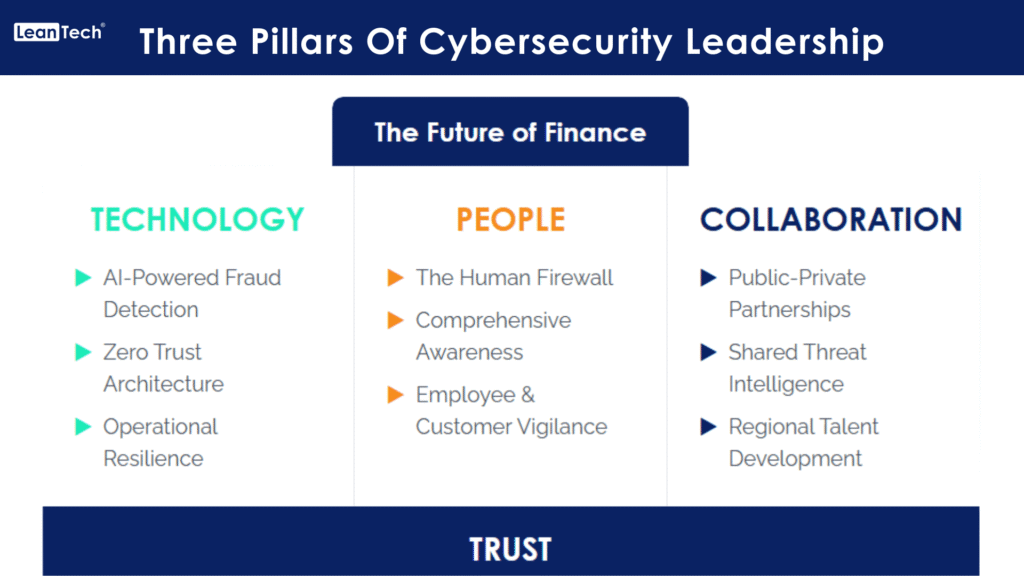

The competitive edge in 2026 banking is shifting toward adaptive workforce models. As core systems modernize, data governance matures, and cybersecurity risk increases, the institutions that “Build” will operate with greater cost-efficiency and system fluency.

Banks that rely on buying talent will continue absorbing higher wage inflation, vacancy delays, and context gaps. Banks that build will expand internal digital leverage and invest in skill capital that compounds over time.

The workforce strategy is becoming as important as the technology strategy. In many cases, it is becoming the technology strategy.

Key Takeaways

- The “Build” strategy delivers measurable savings and reduces wage inflation exposure.

- Upskilling accelerates transformation velocity compared to external hiring.

- Internal context expertise creates execution advantage in regulated environments such as banking.