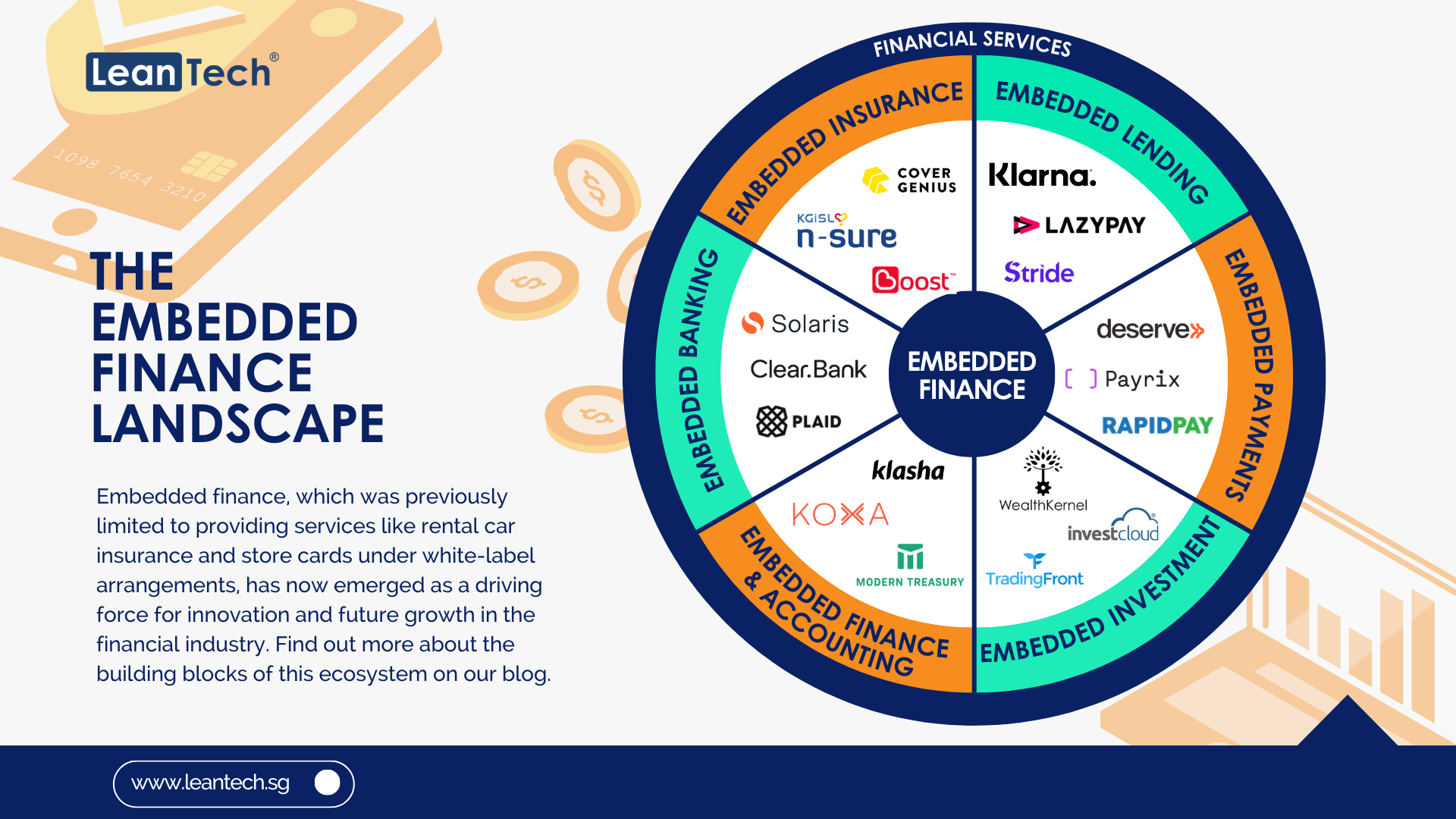

Previously limited to providing services like rental car insurance and store cards under white-label arrangements, embedded finance has now emerged as a driving force for innovation and future growth in the financial industry. This phenomenon reflects various use cases, such as seamlessly integrating payments during online purchases in stores and apps, offering personalised insurance solutions, providing instant payment and credit options, and introducing diverse pay-per-use service models. As non-financial apps or websites increasingly incorporate savings, credit, insurance, and investing tools, experts project that the market for embedded finance applications will experience substantial growth, expanding fivefold from $54.3 billion in 2022 to $248.4 billion by 2032.

Digital disruption in the financial services sector is being driven by branchless neo-banks and agile insurers, aiming to democratise traditional financial offerings like underwriting and overdrafts. The rising popularity of Buy Now, Pay Later (BNPL) schemes allow customers to split significant purchases into manageable payments, boosting conversion rates for retail brands. It is projected that these models will witness a substantial increase in global transaction volume, reaching $596.7B by 2026, up from the current $141.B.

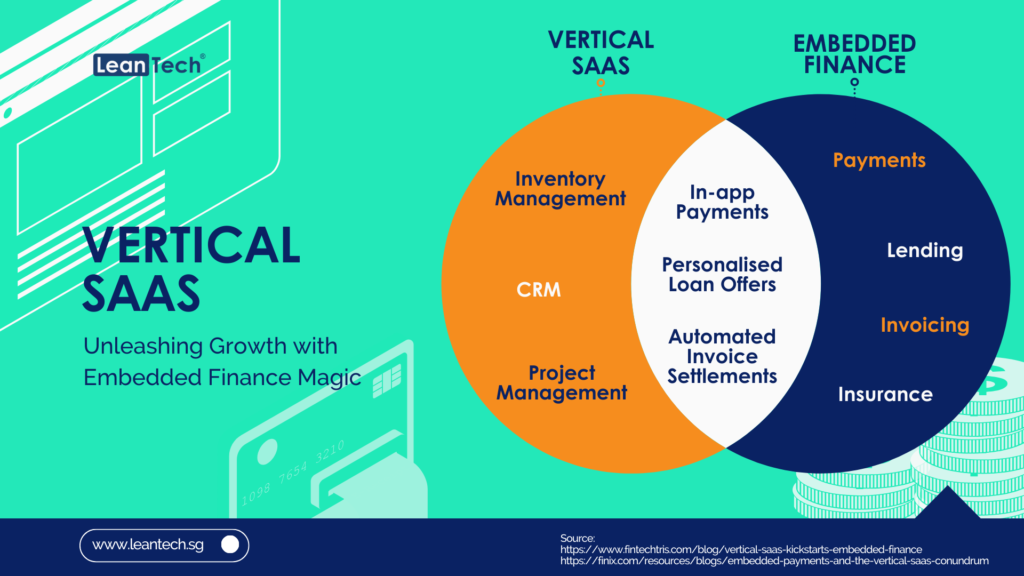

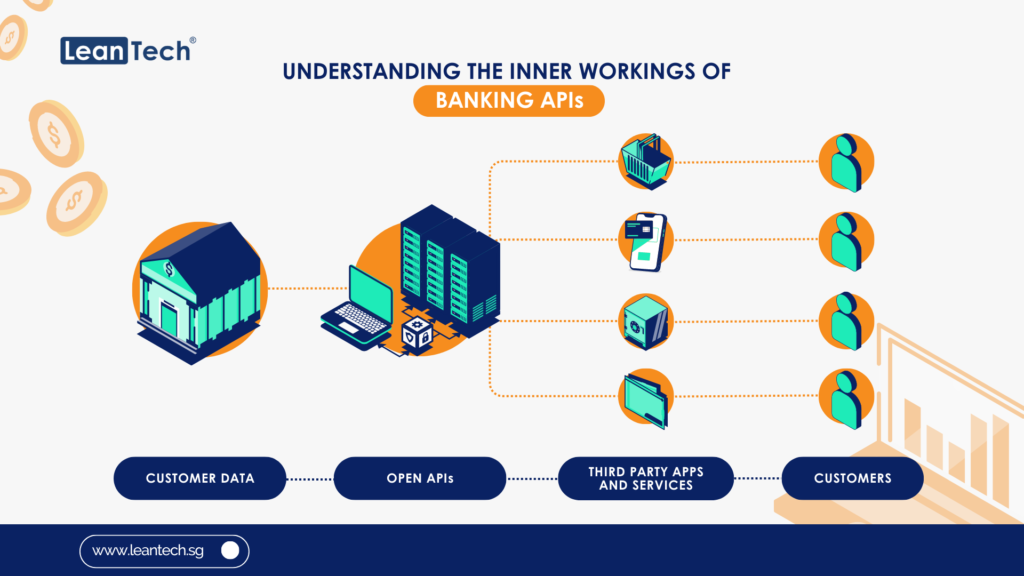

Fintech enablers, particularly those providing APIs, are also contributing to this disruption by facilitating more complex interactions between financial and non-financial entities. However, the real game-changer is embedded finance, offering significant opportunities for big-tech platforms with extensive reach and financial resources to integrate financial services seamlessly. These platforms are leveraging digital identity and payment wallets to expand their customer ecosystems, with the number of such wallets estimated to exceed 5.2 billion globally in 2026, up from the current 3.4 billion. Some ambitious platforms, including certain fintech companies, are even venturing into obtaining banking licenses, solidifying their position in the market.

Revamping the Banking Business Model

The rise of non-banking platforms has had a significant impact on how customers access financial services. These platforms offer user-friendly, instantaneous, and customisable applications, reshaping the traditional banking landscape. In our blog titled “The Embedded Finance Ladscape,” we explore the evolving dynamics of embedded finance, providing consumers with a seamless and frictionless experience when it comes to financial transactions.

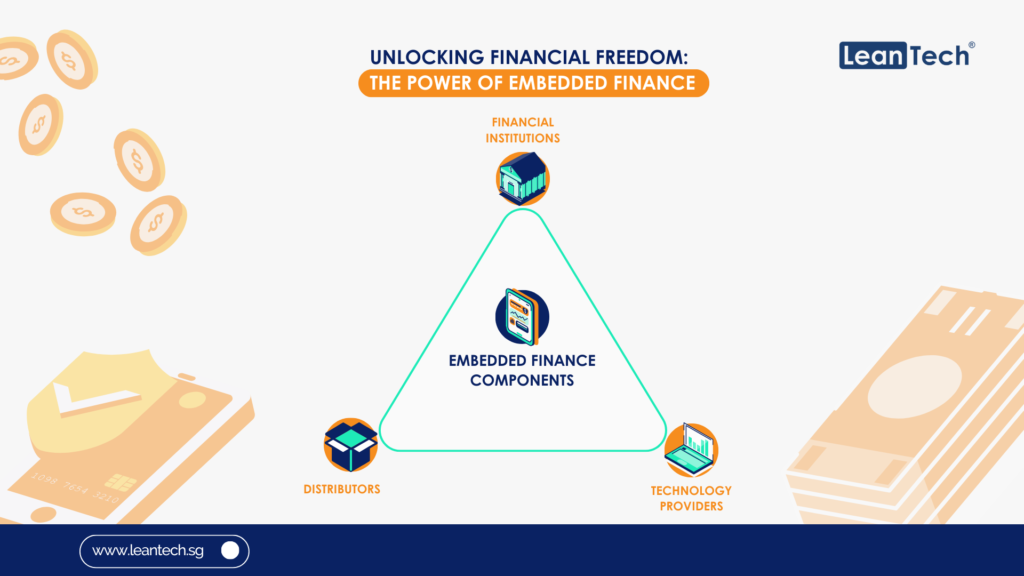

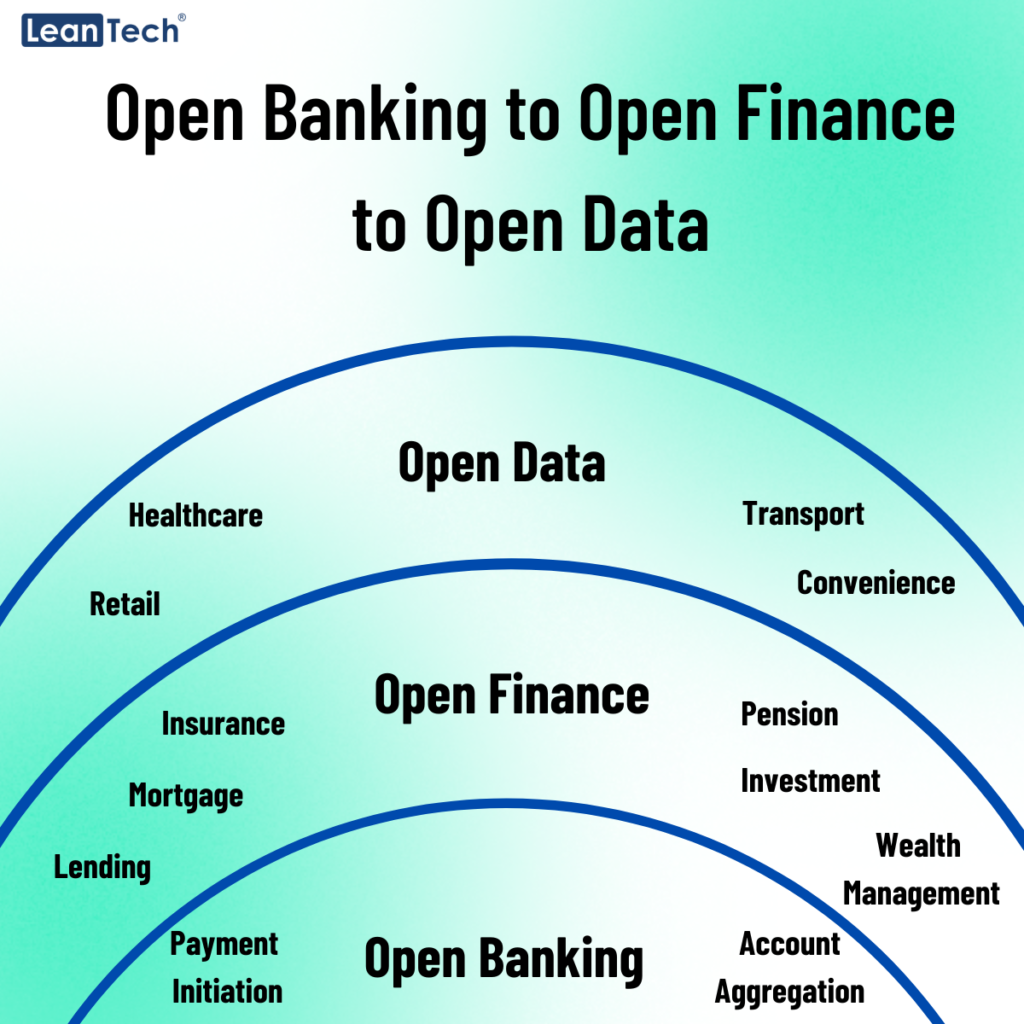

Unlike conventional banking, which typically involves a single integrated licence holder overseeing the entire process, embedded finance relies on multiple distinct roles and players, including platforms, enablers, and licence holders.

While some banks are already taking steps to collaborate with non-banking platforms, they must carefully consider the potential pricing pressures exerted by these platform providers. It is essential for banks to thoroughly evaluate the advantages and drawbacks of such partnerships. Some banks have opted to focus on running the back-office financial infrastructure for ecosystem partners, which may leave them with capital-intensive and heavily regulated activities, potentially reducing direct interaction with end-users.

To address these challenges, banks are exploring various strategies. For instance, some are opening up their platforms to non-banks, while others are venturing into adjacent sectors like travel and mobility, offering embedded insurance and concierge services. By diversifying their offerings and embracing innovation, banks aim to stay relevant and competitive in an ever-changing financial landscape.

Defying Conventional Wisdom

Embedded finance is challenging long-standing beliefs in the banking industry, riding high on powerful trends such as digitisation, customer-centricity, and the rise of ecosystems. As applications extend into areas traditionally dominated by banks, like payments, lending, savings, and banking licenses, the opportunities and impact on business models have grown significantly.

PwC identifies four common assumptions that have prevailed in the industry for over a decade, which embedded finance is now outperforming:

Banks will always own the payments infrastructure: This assumption is being challenged as embedded finance platforms are increasingly handling payment processes.

New entrants won’t enter into lending like they did with payments: Contrary to this belief, new players are now venturing into lending services, disrupting the traditional banking landscape.

Non-financial players won’t apply for banking licenses: Embedded finance has encouraged non-financial entities to seek banking licenses to offer financial services, blurring the lines between different industries.

Banks will continue to own the primary banking account—and thus the customer relationship: The passage suggests that banks may lose some control over the customer relationship as embedded finance platforms gain prominence.

Several reasons contributed to these beliefs. Banks are essential for national and regional economies, but increased regulations and compliance burdens have diverted their focus from long-term business model considerations. This inertia has delayed progress and innovation, allowing faster-moving players to shape the future of banking.

Other factors further complicated the situation. Banks have been slow to realise that customers are more attached to the products or services they desire (e.g., groceries and housing) than the financial products that support them (e.g., payments and mortgages). Additionally, some projections about the size of the embedded finance market were considered inflated, leading to underestimation of fintechs’ and embedded applications’ impact.

The persistence of these assumptions underscores the need for a fundamental change in mindset. To capitalise on the growth potential of embedded finance, banks and other players must rethink their business models and adapt to evolving customer journeys.

Anticipating the Future

The buzz surrounding embedded finance is on the rise, challenging the traditional views and long-standing assumptions about banks. This has led to a fundamental change in mindset within the financial industry and the general public. It has also opened up exciting opportunities for a more seamless and frictionless experience in financial transactions.

Are you considering integrating embedded finance into your company but unsure of where to start? We could have the perfect solution for your needs. Get in touch with us today.