Did Apple just become one of the largest fintech companies in the world? Apple’s journey into the world of financial services began with the introduction of Apple Pay in 2014. What started as a convenient way to make payments has since grown into a comprehensive suite of financial products and services, positioning Apple as a major player in the fintech industry. While Apple Pay may not always steal the spotlight, it plays a pivotal role in the company’s future plans.

Strategic Growth

Apple’s top leadership, including CEO Tim Cook, acknowledges the significance of Apple Pay. Cook has consistently praised its simplicity and popularity among customers. Apple’s recent acquisition of CreditKudos is a clear indication of its ambition to exert more control over payment approvals and processing, potentially reducing its reliance on external payment processors. Moreover, industry observers anticipate the introduction of new Apple device subscription services, further expanding the company’s financial offerings. It’s financial journey has been marked by strategic partnerships with major players in the financial industry, including American Express, Visa, and JP Morgan. The company’s commitment to expanding its global footprint is evident with the continued introduction of Apple Pay in new markets, most recently in Chile and Morocco. Apple’s merchant-focused mobile payment service, Tap to Pay, is also making waves in various countries, simplifying transactions for businesses and consumers alike.

Apple’s venture into financial services has been met with remarkable success. Notably, Apple Savings, the company’s high-yield savings account introduced in partnership with Goldman Sachs, generated a staggering $10 billion within a few weeks of its launch. This achievement stands in stark contrast to the slower growth rates experienced by challenger banks like Monzo and Starling.

Global Dominance in Mobile Payments

Apple Pay has emerged as a dominant force in the mobile payments sector. An estimated 51% of iPhone users worldwide have embraced the service, up from 43% in 2019. Mobile payments are on the verge of surpassing cash payments in stores, with the UK leading the way, where one in three people no longer carry physical cash. Apple strategically targets the generational shift toward digital payments, particularly among users under 30. The company’s “Pay The Apple Way” marketing campaign emphasises the ease of use, resonating with this tech-savvy audience. Apple’s strong reputation and high user satisfaction further fuels its success in the financial services arena.

Apple’s Vision

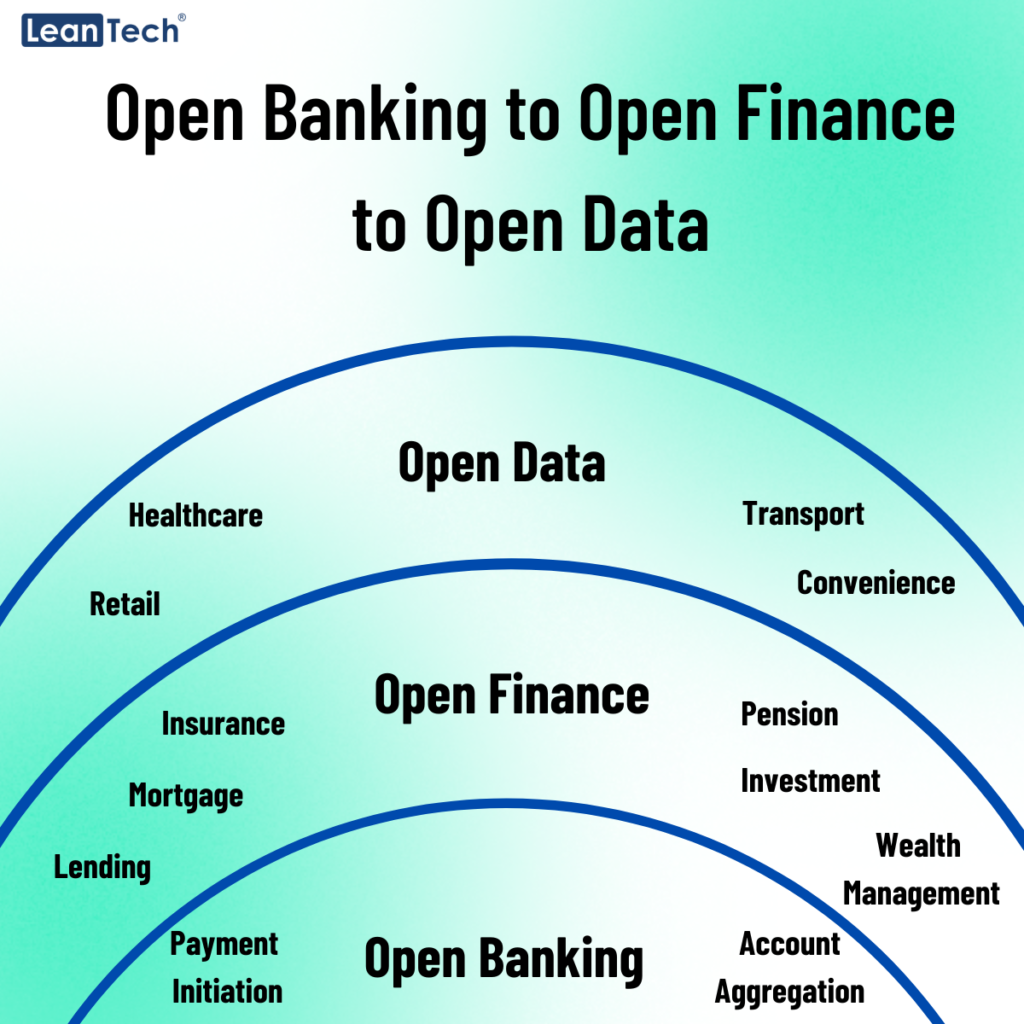

Apple is steadily building a financial empire, positioning itself to disrupt the traditional financial services landscape. With a dedicated user base and an ever-expanding portfolio of financial products, including credit options, savings accounts, and merchant tools, Apple is poised to become a major player in the financial industry of tomorrow.

From its roots as a computer manufacturer, Apple has evolved into a tech giant with a diversified product lineup. Its strategic entry into financial services, marked by innovation and an unwavering user loyalty, places Apple on the trajectory to become a formidable contender in the future of the financial industry.