Banking in the age of rapid change is an exciting and challenging time for both consumers and financial institutions. The rise of technology has brought about a number of changes that have significantly impacted the way we bank and interact with our financial institutions.

From Paper to Pixel: The Digital Banking Revolution

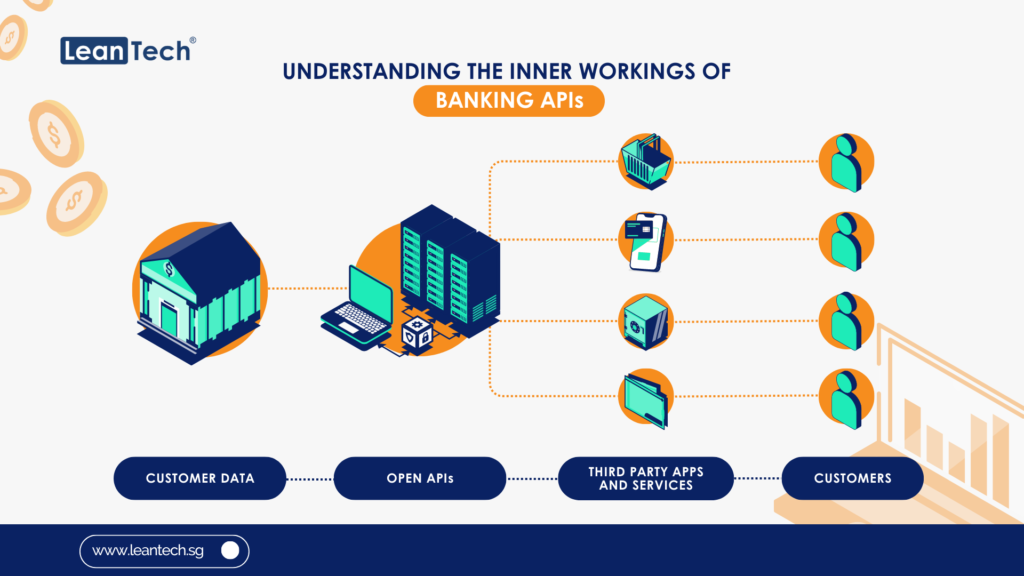

One of the biggest changes in the banking industry in recent years has been the shift towards digital banking. With the rise of smartphones and mobile devices, consumers now have access to their financial information and banking services at their fingertips. This has led to a significant increase in the use of mobile banking apps and online banking portals, which has made it much easier for consumers to manage their finances on the go.

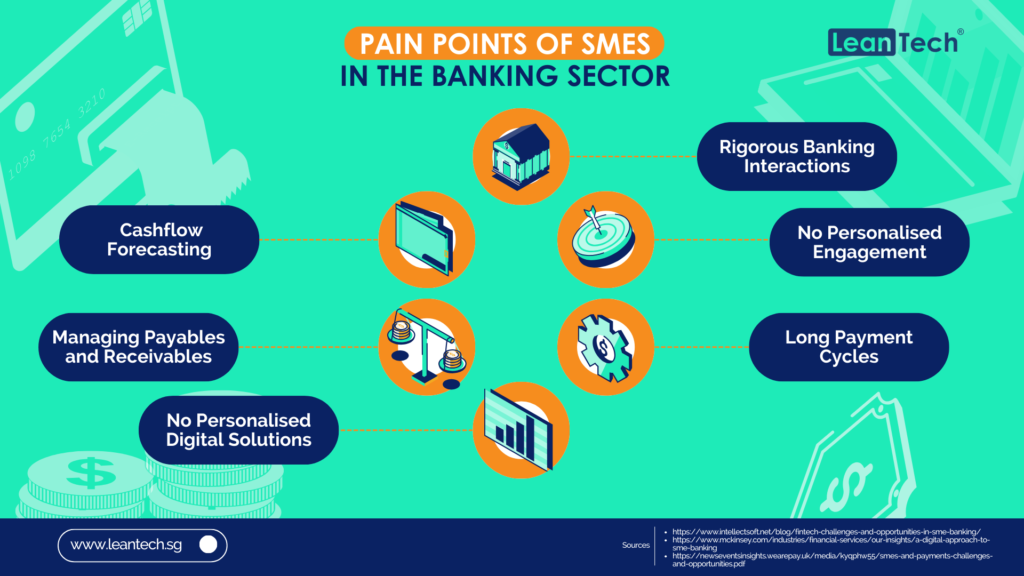

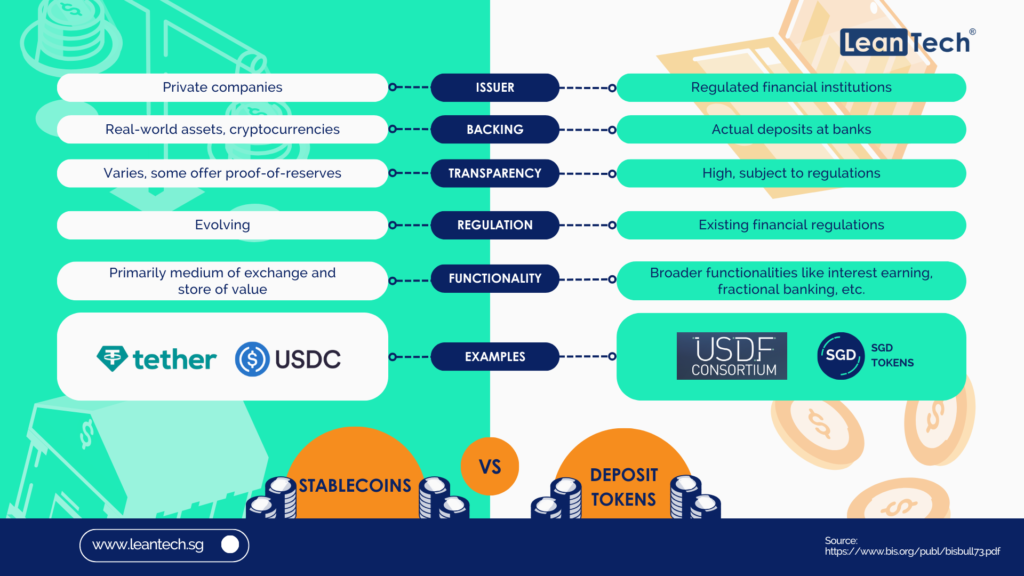

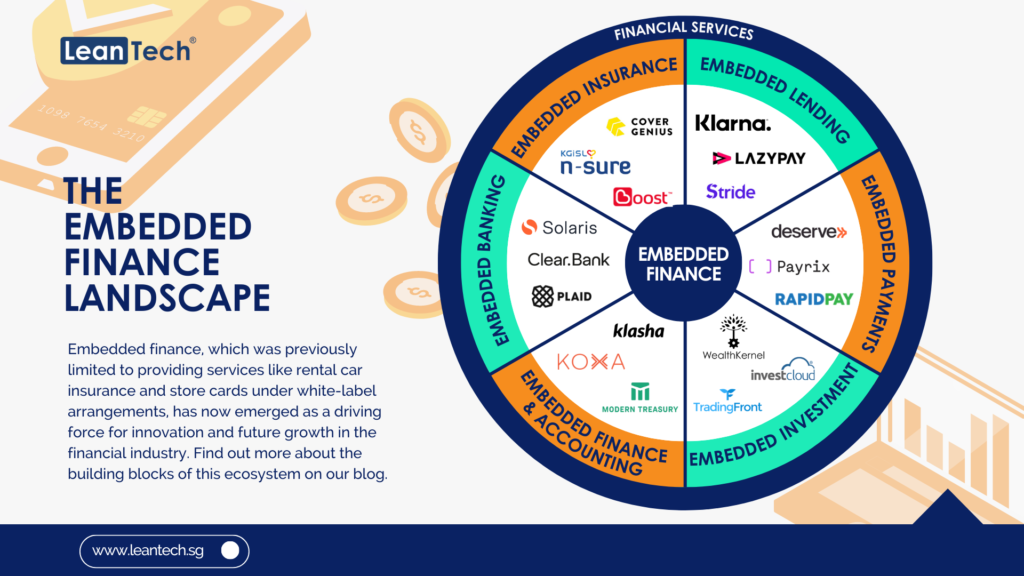

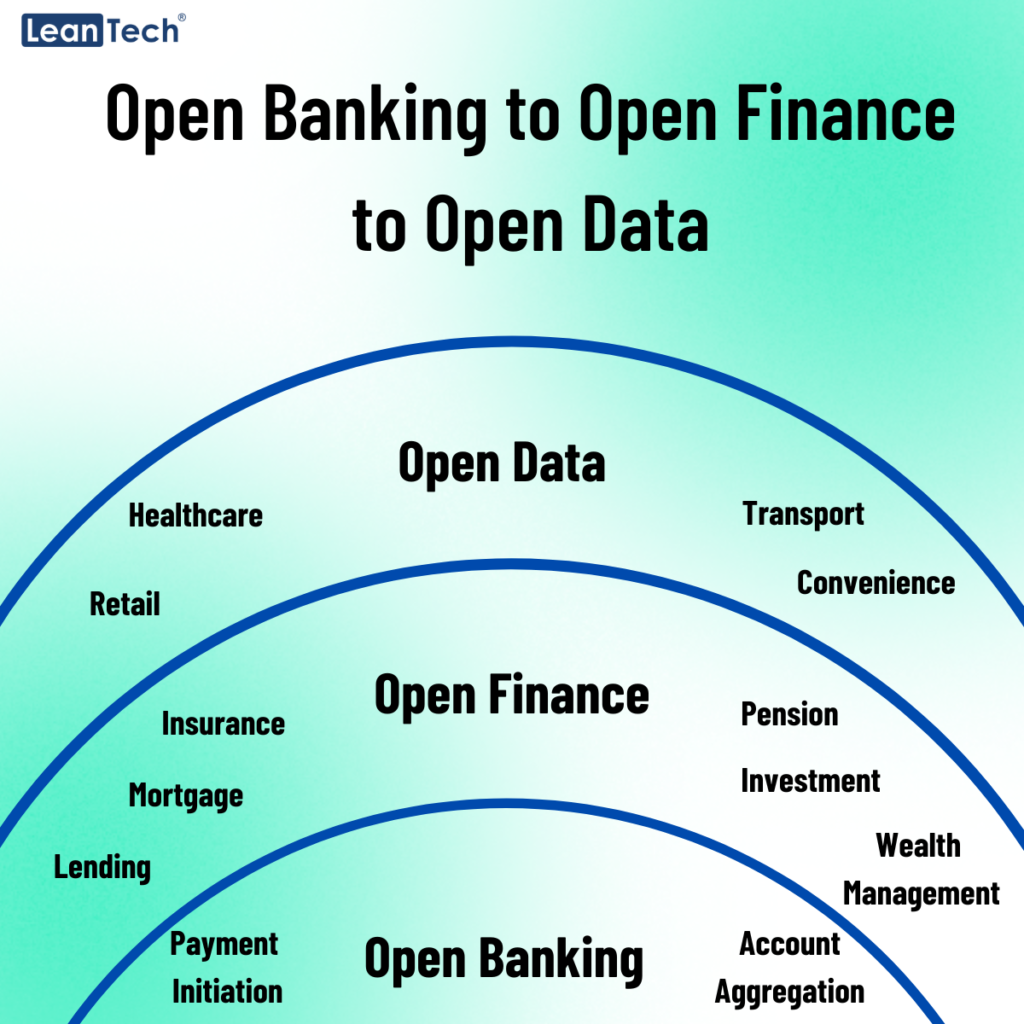

Another major change in the banking industry has been the rise of fintech companies. These companies, which focus on using technology to improve financial services, have disrupted the traditional banking model by offering consumers new and innovative ways to manage their money. This includes everything from online lending platforms to digital wallets and payment apps.

The rise of digital banking and fintech has also brought about new security challenges for financial institutions. With more sensitive financial information being stored and shared online, there is an increased risk of data breaches and cyber attacks. Financial institutions have had to adapt to these new security challenges by investing in advanced security technologies and implementing strict security protocols.

Stepping into the Future: Charting a Course for Progress

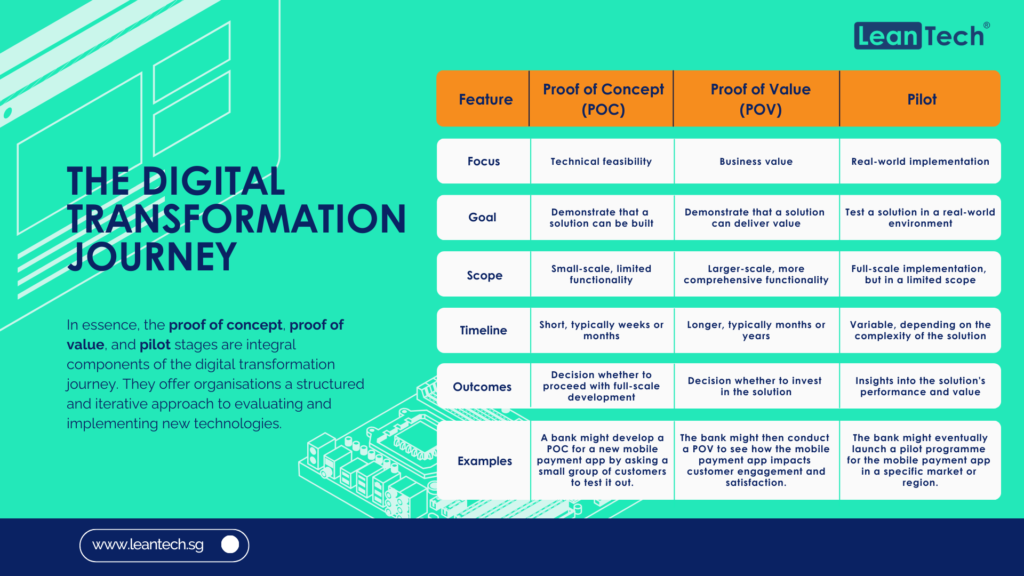

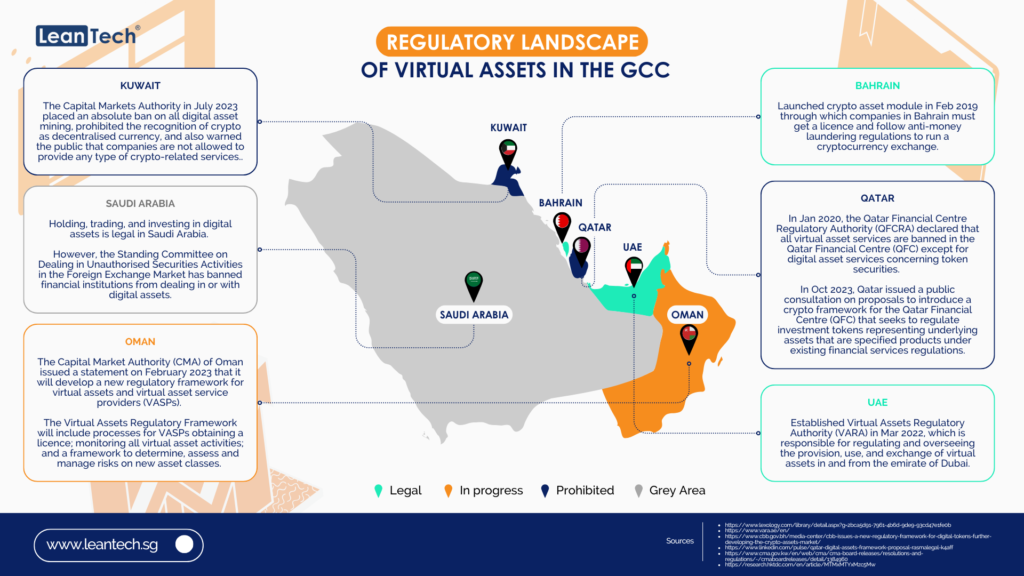

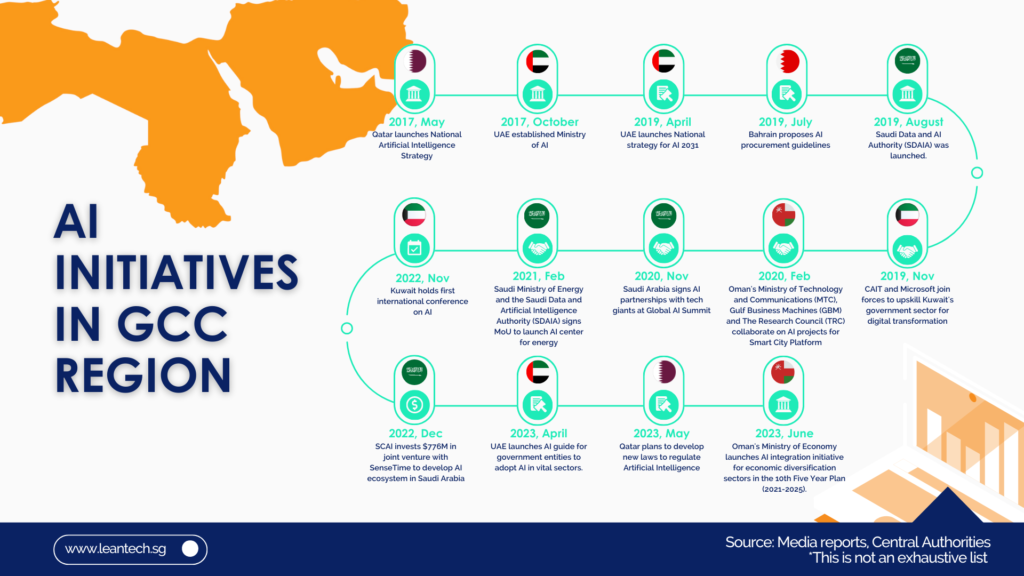

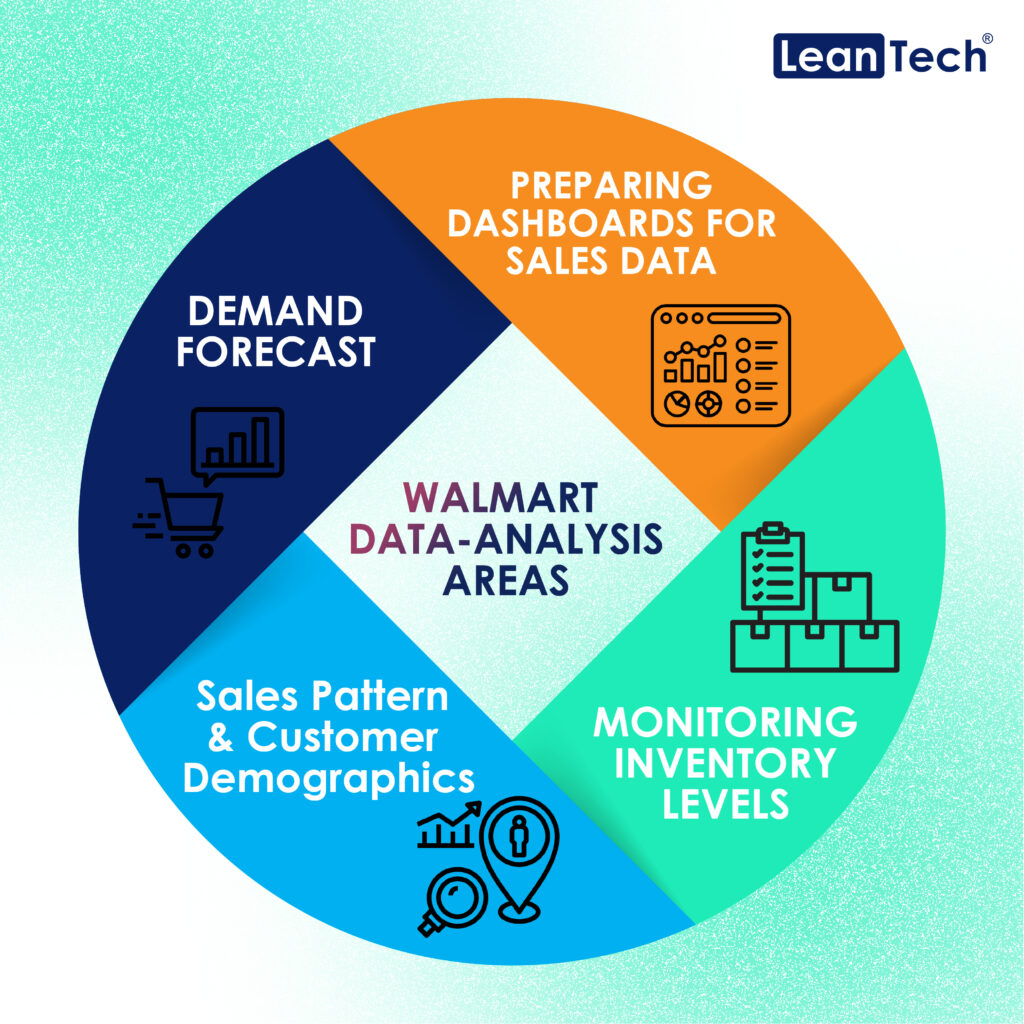

Despite these challenges, the banking industry is well-positioned to adapt to the rapid changes brought about by technology. Many financial institutions have already begun to adopt new technologies and business models to stay ahead of the curve. This includes everything from investing in artificial intelligence and machine learning to partnering with fintech companies to offer new services to their customers.

In conclusion, the banking industry is facing rapid change as technology continues to evolve. However, with the right strategies and investments, financial institutions can stay competitive and continue to meet the needs of their customers in the digital age. Consumers also need to be vigilant, and stay informed about the security protocols and measures of the financial institutions they are using to ensure their sensitive financial information is well-protected.