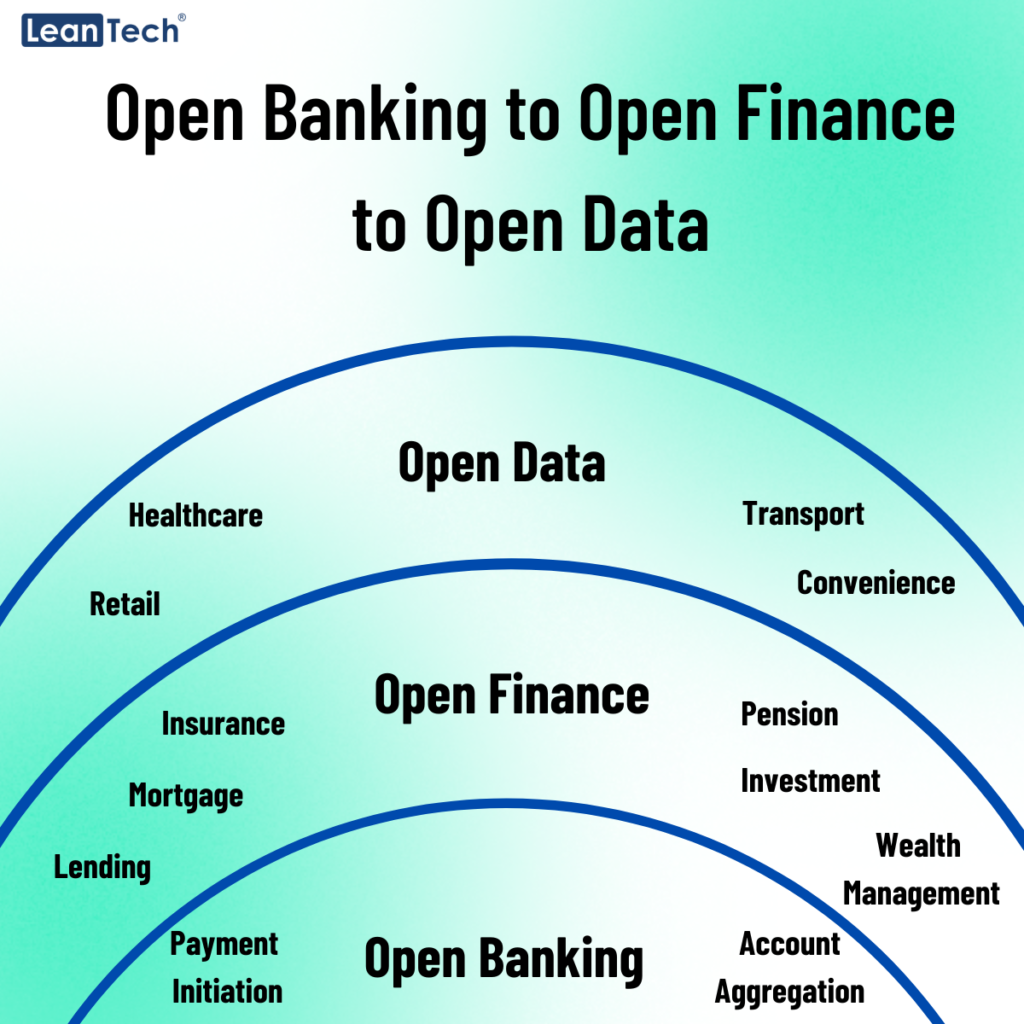

In the digital age, the financial landscape has undergone a transformative shift with the advent of Application Programming Interfaces (APIs). APIs have revolutionised various industries, and banking is no exception. In this blog, we will delve into the intriguing world of banking APIs, exploring their functionalities, benefits, and the mechanisms that drive them.

What is a Banking API?

An API, or Application Programming Interface, is a set of protocols and tools that enable different software applications to communicate and interact with each other. In the context of banking, APIs serve as intermediaries, facilitating seamless data exchange and interactions between various financial services and third-party applications. These APIs act as bridges between the bank’s systems and external applications, enabling a wide range of functionalities without compromising security.

Functions of Banking APIs

Banking APIs offer an array of functionalities that enhance customer experiences, streamline processes, and encourage innovation in the financial sector. Some key functions include:

Account Information Retrieval: Banking APIs allow third-party applications to securely access account information, such as transaction history, balance, and account details. This functionality forms the foundation for various personal finance management apps.

Payment Initiation: APIs enable the initiation of payments directly from external applications. This feature facilitates efficient fund transfers and payments without requiring users to log in to their banking portals.

Identity Verification: Banking APIs aid in identity verification and authentication processes. This is particularly useful in compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Loan and Credit Applications: With APIs, customers can apply for loans or credit through external platforms, making the application process smoother and more accessible.

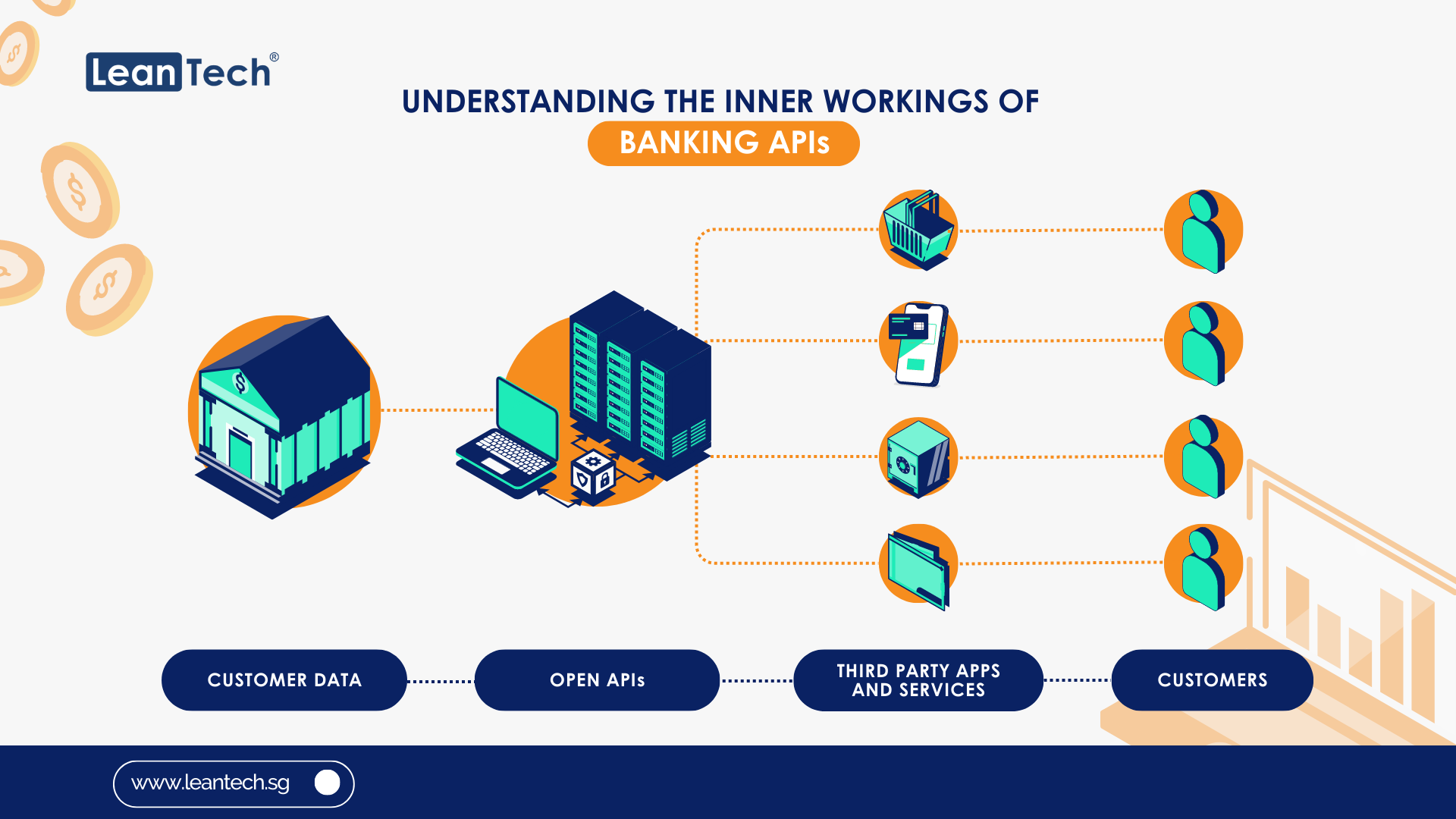

How Banking APIs Work

The operation of banking APIs follows a structured flow:

Request Initiation: A user initiates a request through a third-party application, such as a mobile banking app, payment gateway, or budgeting tool.

API Call: The application sends an API call to the bank’s servers, requesting a specific action or information.

Authentication and Authorisation: The bank’s servers verify the authenticity of the request through authentication mechanisms. Once verified, the request is authorised to access the required data or perform the specified action.

Data Exchange: The requested data or action is processed, and the bank’s servers send back a response containing the relevant information or confirmation of the action’s completion.

Benefits of Banking APIs

The implementation of banking APIs brings forth several advantages:

Enhanced Customer Experience: APIs enable seamless integration of banking services into third-party applications, leading to a more convenient and efficient experience for customers.

Innovation and Collaboration: APIs foster innovation by allowing third-party developers to create novel financial products and services that build upon existing banking infrastructure.

Efficiency and Cost Reduction: APIs streamline processes, reducing the need for manual interventions. This leads to operational efficiency and potential cost savings for both banks and customers.

Challenges and Security Concerns

Despite their transformative potential, banking APIs come with their share of challenges, primarily centered around security and data privacy. Ensuring the integrity of sensitive financial data while enabling seamless interactions is a delicate balance that banks must maintain. One significant challenge lies in robust authentication and authorisation mechanisms. As APIs become conduits for data exchange, banks must implement sophisticated methods to confirm the identity of users and applications initiating requests. Failure to do so could expose customer data to malicious actors.

Additionally, the interconnected nature of APIs poses a risk of propagation in the event of a security breach. A vulnerability in one API could potentially affect multiple interconnected systems, amplifying the impact of a breach. It is imperative that banks establish comprehensive security protocols, including encryption, regular security audits, and real-time monitoring, to mitigate these risks and ensure the utmost protection of customer information.

The Way Forward

These interfaces facilitate smooth communication between banking systems and external applications, unlocking a myriad of possibilities for the future of finance. As the industry continues to evolve, it is crucial for banks to balance innovation with security, ensuring that the benefits of APIs are maximised while maintaining the highest standards of data protection.