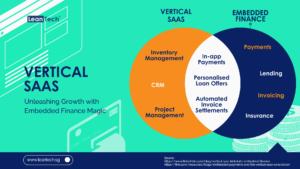

In the dynamic landscape of software-as-a-service (SaaS), vertical specialisation has become a key strategy for businesses aiming to cater to specific industries with tailored solutions. Vertical SaaS businesses, with their niche-specific software solutions, often face a unique challenge – the potential for slow growth due to their narrow industry focus. Vertical SaaS companies, by design, cater to specific industries with tailored solutions. While this specialisation ensures deep expertise and relevance within a particular sector, it can hinder growth beyond that niche. The challenge lies in expanding the customer base beyond the limited scope of the chosen industry, leading to slower growth rates compared to horizontal SaaS counterparts.

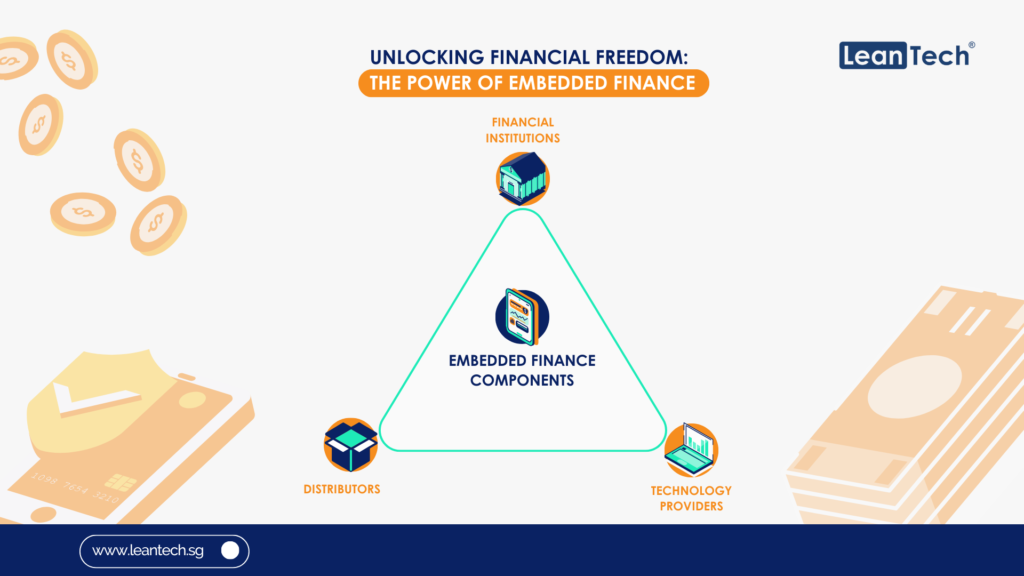

To tackle this, embedded finance can act as a catalyst for vertical SaaS businesses, addressing the slow growth conundrum by offering a broader array of services. By seamlessly integrating financial functionalities into their specialised software, these companies can attract a wider audience and provide added value to existing customers.

Expanding beyond niche boundaries

One key way embedded finance fuels growth is by enabling vertical SaaS businesses to diversify their revenue streams. Beyond the core software offerings, these companies can now tap into financial transactions occurring within their platforms. Whether it’s transaction fees, commissions, or subscription-based financial services, the additional revenue sources contribute to a healthier bottom line. Embedded finance allows vertical SaaS businesses to extend their reach beyond the narrow confines of their chosen industry. By incorporating financial tools that have universal applicability, these companies can attract customers from related sectors or businesses with overlapping needs. This expansion broadens the addressable market and injects new growth potential.

Consider a vertical SaaS company specialising in legal practice management software. By integrating embedded accounting functionalities, such as invoicing, time tracking, and financial reporting, the software becomes attractive not only to law firms but also to freelancers, consultants, and small businesses in need of robust financial tools. The embedded finance feature positions the company to penetrate multiple markets, overcoming the limitations of a singular industry focus.

Embedded finance not only attracts new customers but also enhances customer retention. By providing a comprehensive solution that seamlessly integrates operational and financial aspects, vertical SaaS businesses create stickier relationships with their user base. Customers are more likely to stay loyal when they can manage both their industry-specific tasks and financial transactions within a single, integrated platform.

Looking forward

The slow growth often associated with the vertical SaaS model doesn’t have to be an inherent limitation. Embedded finance emerges as a strategic enabler, breaking down barriers and unlocking new avenues for growth. By diversifying revenue streams, expanding beyond niche boundaries, and enhancing customer stickiness, vertical SaaS businesses can thrive in a competitive landscape. As the integration of financial functionalities continues to evolve, it presents an exciting opportunity for these businesses to redefine their growth trajectories and make a lasting impact on their chosen industries.