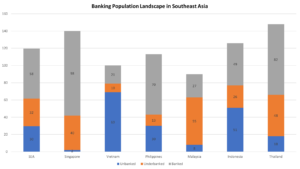

According to central authorities of SEA countries report, there’s a significant proportion of adults in Southeast Asia, around 60%, that have limited or no access to banking services. This problem is most prominent in Indonesia, where approximately 42 million adults are underbanked and almost 100 million are unbanked. Additionally, the region faces a considerable funding gap for small and medium-sized enterprises. Digital banking can help address these issues. The rise of smartphones and internet access is driving digitalization in the retail banking industry of Southeast Asia, leading to a surge in the adoption of mobile banking apps, online banking platforms, and e-wallets.

The Rise of Digital Retail Banking in Southeast Asia

Smartphones and internet access have revolutionized the way people interact with the world, including the banking industry. Consumers are increasingly using mobile banking apps, online banking platforms, and e-wallets to manage their finances. This has resulted in a more accessible and convenient banking experience for consumers. One of the most significant advantages of digitalization in the retail banking industry is that consumers can access banking services more easily, regardless of their location. Consumers no longer have to visit a physical bank branch to conduct transactions or check their account balances. Instead, they can do everything online or through a mobile app, making banking more convenient and accessible than ever before.

As a result of these changes, banks are investing heavily in digital technologies to meet changing consumer demands. They are adopting new technologies and creating innovative solutions to improve their digital offerings such as mobile payments. The adoption of mobile banking apps, online banking platforms, and e-wallets is on the rise helping consumers manage their finances on a daily basis. As digitalization continues to drive change in the retail banking industry, consumers can expect to see even more improvements in the accessibility, convenience, and flexibility of banking services.

The banking industry continues to evolve, new types of banks have emerged to meet the changing needs of consumers. In Southeast Asia, digital banks, challenger banks, and neobanks have become increasingly popular in the B2C space. These banks offer a range of innovative services and products that cater to the needs of modern consumers, such as seamless mobile banking, personalized financial advice, and advanced security features. To learn more about these different types of banks and their offerings, be sure to check out our infographics:

The Fiercely Competitive Retail Banking Sector in Southeast Asia

The banking industry in Southeast Asia is highly competitive, with both local and foreign banks vying for a greater market share. This competition benefits consumers by creating a wide range of options for banking products and services, as well as more competitive interest rates and fees. Some key players in the banking industry include DBS Bank, United Overseas Bank, OCBC Bank, Citibank, and Standard Chartered Bank. These banks offer a range of products and services to consumers, such as savings accounts, checking accounts, credit cards, loans, and investment products.

They also provide online and mobile banking services, making it easier for consumers to access their accounts and conduct transactions on-the-go. Local banks are often more familiar with the local market, including the cultural and regulatory environment, which can give them an advantage in providing tailored solutions to customers. Foreign banks, on the other hand, may offer more global expertise and access to international markets.

In order to attract and retain customers, banks are constantly improving their products and services. They invest heavily in technology, such as artificial intelligence, data analytics, and blockchain, to enhance their operations and provide a more seamless experience for customers. Overall, the banking industry is highly competitive, with local and foreign banks offering a wide range of products and services to meet the needs of consumers. As technology continues to advance, banks will need to stay ahead of the curve to remain competitive and provide the best possible experience for their customers.

Financial Inclusion: A Key Trend in Southeast Asia’s Retail Banking Sector

Many banks recognize the importance of providing financial services to underserved rural communities and individuals who lack access to traditional banking. This includes individuals who may not have access to a physical bank branch, have limited financial literacy, or lack the necessary documentation to open a bank account. By providing financial services to these communities, banks can help promote financial inclusion and reduce poverty.

Digital technologies have made it easier and more cost-effective for banks to reach these communities. Mobile banking apps and online platforms can provide access to banking services and information without requiring a physical branch. Banks are also developing innovative solutions such as biometric authentication and blockchain-based identification systems to improve access to financial services for those who lack the necessary documentation. Financial inclusion is an important step towards reducing poverty and promoting economic growth. By providing access to financial services, individuals and small businesses can save, invest, and grow their assets. This can lead to increased economic activity and job creation, ultimately contributing to the overall development of a country.

Charting the Digital Banking Frontier: Trailblazing Challenger Banks and Neobanks in Southeast Asia

The advent of technology has brought forth a transformative wave in the banking industry, reshaping traditional banking practices into the realm of digital retail banking. Nowhere is this transformation more apparent than in the bustling and rapidly evolving Southeast Asian region. With its burgeoning population, increasing smartphone penetration, and a thriving e-commerce landscape, Southeast Asia has become a fertile ground for the rise of digital challenger banks and neobanks. However, the number of challenger banks in the region has surpassed that of neobanks, signifying a shift towards digital banking and reflects the increasing demand for accessible and technologically advanced financial services.

Sustainability: Integrating Environmental Concerns into Banking

Southeast Asia is increasingly becoming aware of sustainability and environmental concerns. As a result, many banks in the region are integrating sustainability into their products and business strategies. This includes offering sustainable financing options, such as green bonds, which provide funding for projects with environmental benefits, such as renewable energy and energy efficiency.

Banks are also developing other financial products that promote environmental sustainability, such as loans for sustainable agriculture and clean technology investments. By integrating sustainability into their business strategies, banks can meet the growing demand from consumers for environmentally responsible products and services.

Furthermore, banks are also focusing on their own environmental impact, with many implementing sustainable practices in their operations. This includes reducing their carbon footprint through energy-efficient buildings and sustainable supply chains, as well as engaging in corporate social responsibility initiatives that support environmental causes.

The way forward

The rise of digital retail banking in Southeast Asia is transforming the industry and providing consumers with greater access to banking services. Banks are investing heavily in digital technologies to meet the changing demands of consumers, while also focusing on financial inclusion and sustainability. As the industry continues to grow and evolve, it is an exciting area to watch in the coming years.

Are you interested to know more about the digital transformation and help scale your organisation? The check out our courses: