In the dynamic landscape of the financial industry, core banking systems serve as the linchpin for managing crucial functions like customer accounts, transactions, and loans. However, the prevalence of legacy systems has prompted financial institutions to contemplate modernising their core banking infrastructure. But firstly, let’s explore the two predominant approaches to core banking modernisation: on-premises systems and cloud-based systems.

On-Premises Systems: Ownership and Control

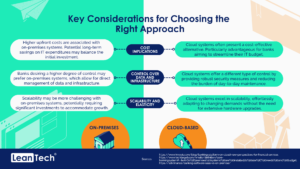

On-premises systems, as the name suggests, are owned and operated by the bank itself, typically residing within the bank’s data centre. One key advantage of on-premises systems lies in the significant level of control they afford to financial institutions over their data and infrastructure.

In the on-premises model, banks have direct oversight of the hardware, software, and the entire IT environment. This granular control is advantageous for institutions with specific security and compliance requirements. However, this control comes at a cost, as on-premises systems can be expensive to set up, maintain, and upgrade. The financial institution is responsible for hardware purchases, software licenses, and ensuring the availability of skilled IT personnel.

Cloud-Based Systems: Outsourcing for Efficiency

Cloud-based systems, on the other hand, involve hosting and management by a third-party provider. Financial institutions leveraging cloud-based systems eliminate the need to own or operate hardware and software, resulting in potential cost savings on IT expenditures.

In the cloud-based model, the responsibility for infrastructure maintenance, software updates, and security measures is transferred to the external service provider. This can free up resources for the financial institution to focus on core business activities. Cloud-based systems are designed to be scalable and elastic, allowing for seamless adjustments to accommodate fluctuations in demand. This flexibility is particularly beneficial in the rapidly evolving landscape of the financial industry.

Key Considerations for Choosing the Right Approach

Determining the ideal approach to core banking modernisation necessitates a thoughtful evaluation of various factors. The following considerations should guide financial institutions in making an informed decision:

But a key question still remains: what is the need for core banking modernisation? Well, banking modernisation is imperative in the contemporary financial landscape due to several pressing reasons:

1. Addressing the need for fluid digital interactions: The surge in demand for seamless, connected digital experiences has become a driving force behind banking modernisation efforts. Legacy core banking systems, built on antiquated technology and outdated programming languages, face significant challenges in compatibility with newer systems. This incompatibility hinders the integration of legacy platforms with modern systems, leading to disjointed and disruptive digital experiences for both bank employees and customers.

2. Intrinsic challenges of legacy platforms: Numerous legacy core banking systems grapple with inherent challenges that hinder their flexibility and upgrade capabilities. These systems are frequently extensively tailored and depend on business rules hard-coded into their architecture. Paired with their lack of compatibility with contemporary operating systems and programming languages, this complexity renders updates a formidable task, if not unattainable. Moreover, the aged nature and inadequate documentation of these systems, some with a history spanning more than 30 years, compound the difficulties experienced by both employees and customers. These obstacles run counter to the fundamental tenets of digital transformation and innovation.

3. Fierce market rivalry in the banking sector: The banking industry has become highly competitive, with traditional institutions facing competition from neobanks, fintech startups, and tech giants such as Amazon, Google, Meta, and Apple. Unlike traditional banks, these new entrants have technology ingrained in their DNA, offering cloud-based and cloud-native solutions. To stay competitive, traditional banks can no longer afford to operate on decades-old legacy systems that lack the agility and innovation required in the rapidly evolving financial landscape.

4. Swift evolution of financial regulations: The regulatory environment within the financial services sector is complex and constantly evolving. Predictions for 2023 indicate emerging concerns about consumer protections, discussions around digital assets, and the impact of climate change. To navigate these changes and ensure compliance, banks need the agility and flexibility to adapt to new regulations and requirements. Legacy core banking systems, with their rigidity and outdated structures, fall short in delivering the responsiveness demanded by the dynamic regulatory landscape.

The path a financial institution chooses for core banking modernisation is entirely dependent on its specific needs, objectives, and priorities. After determining the preferred direction, the next consideration is establishing the appropriate pace of transformation. Some institutions opt for a comprehensive “complete overhaul” approach, characterised by the simultaneous replacement of core banking systems. On the other hand, others may favour a more gradual, progressive transformation, implementing incremental changes over time.

The appeal of the complete overhaul modernisation strategy lies in its simplicity, involving a singular, comprehensive delivery. However, it inherently carries a higher risk compared to the iterative and incremental nature of progressive transformation. This more measured approach allows institutions to adapt and refine their systems progressively, minimising potential risks associated with large-scale overhauls. The choice between these approaches ultimately hinges on the institution’s risk tolerance, capacity for change, and overarching strategic vision for core banking modernisation.