In the ever-evolving landscape of the digital age, a fascinating FinTech innovation has been quietly but significantly reshaping the way we interact with our finances. It’s called embedded finance, and it’s the technological wizardry that empowers non-financial companies to seamlessly integrate payment and banking services into their offerings. In essence, it’s the bridge between consumers and businesses, bringing payment processing services right to where consumers are.

Imagine you’re sipping your favorite Starbucks brew, and with a few taps on your smartphone, you not only pay for your coffee but also accrue loyalty points for those delightful rewards. Or perhaps you’ve summoned a ride through a popular ride-hailing app and effortlessly settled the fare using your digital wallet or linked bank account. These everyday experiences are brought to you by embedded finance.

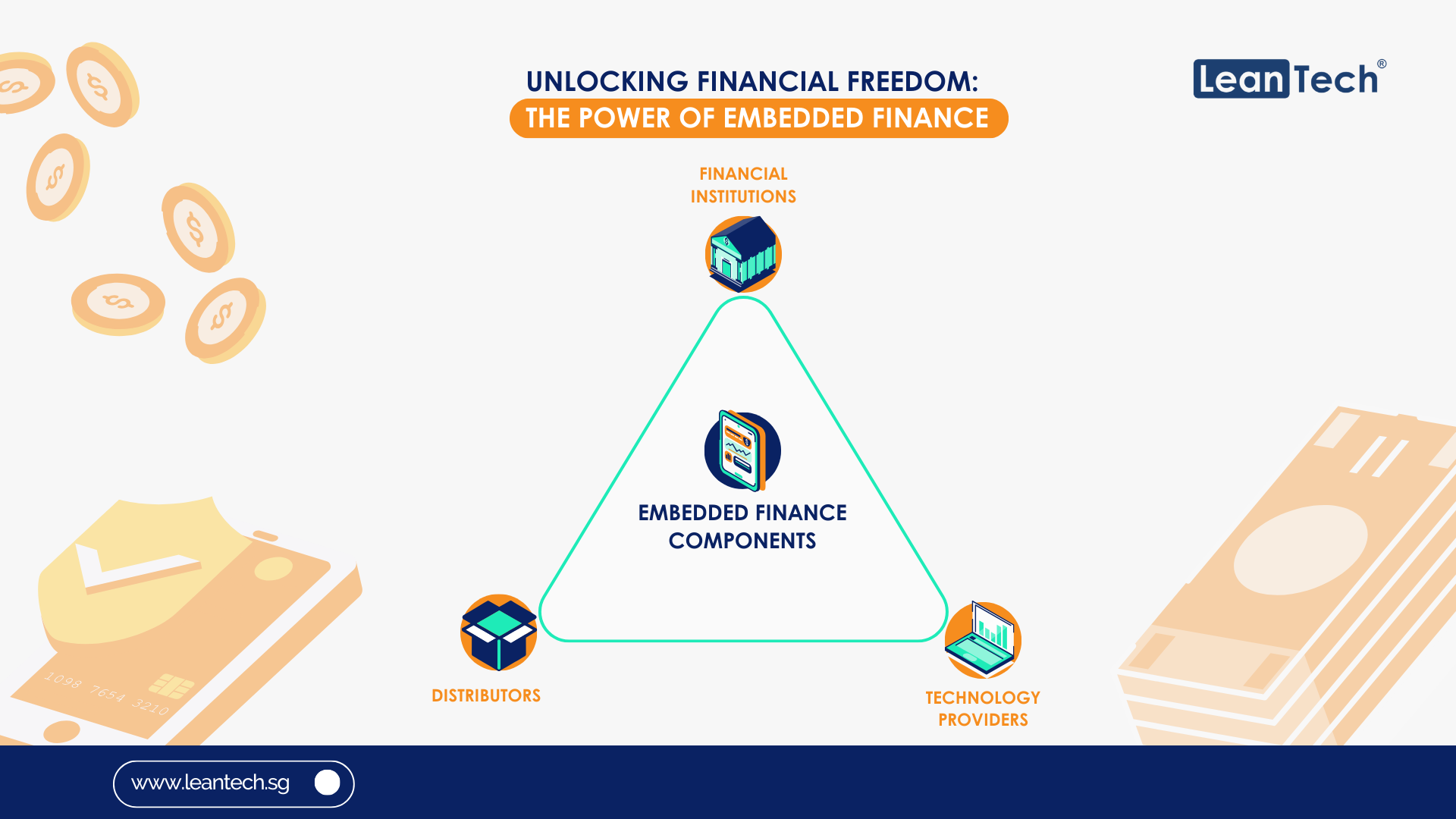

In the world of embedded finance, companies that embrace this innovation become the distributors. These distributors span various industries, from software firms to traditional retailers and even telecom giants, providing customers with the seamless financial services they crave. But how does it all come together?

Let’s delve into the two essential components that make embedded finance tick:

1. Technology Providers:

These tech-savvy entities play a pivotal role in the embedded finance ecosystem. They enable the integration of financial services such as payments, lending, and banking into the offerings of distributors. How? By opening up their APIs (Application Programming Interfaces) to others, making them accessible via the cloud or a simple URL. These tech providers handle the maintenance and configuration of these APIs, sparing distributors the need for a dedicated tech team to navigate the integration process. Typically, these technology providers are FinTech pioneers or forward-thinking banks and financial institutions.

2. Balance Sheet Providers:

Now, it’s not enough to have the technology; you need the financial muscle too. This is where balance sheet providers enter the picture, often represented by banks or financial institutions. They are the financial backbone that pairs seamlessly with the technological solution provided by the distributors. With this partnership in place, distributors are armed to offer a whole range of financial services to their end users. These services may include accepting payments, facilitating investments, and even providing insurance coverage. Crucially, distributors don’t have to break a sweat setting up their financial infrastructure; they can focus on boosting sales and enhancing the customer experience.

So, how does it all come together for the end user? Picture it as a two-layer cake, with the technology layer (the API) placed delicately on top of the balance sheet provider’s foundation. This layered approach ensures a smooth and secure delivery of financial services to consumers.

In essence, embedded finance is revolutionising the way we interact with money. It’s making financial services more accessible, convenient, and integrated into our daily lives. As technology continues to advance, we can only imagine the innovative ways embedded finance will further bridge the gap between consumers and businesses, making our financial experiences more seamless and empowering us to take control of our financial freedom. So, the next time you sip that latte or hail that ride, remember that embedded finance is working behind the scenes to make it all effortless.