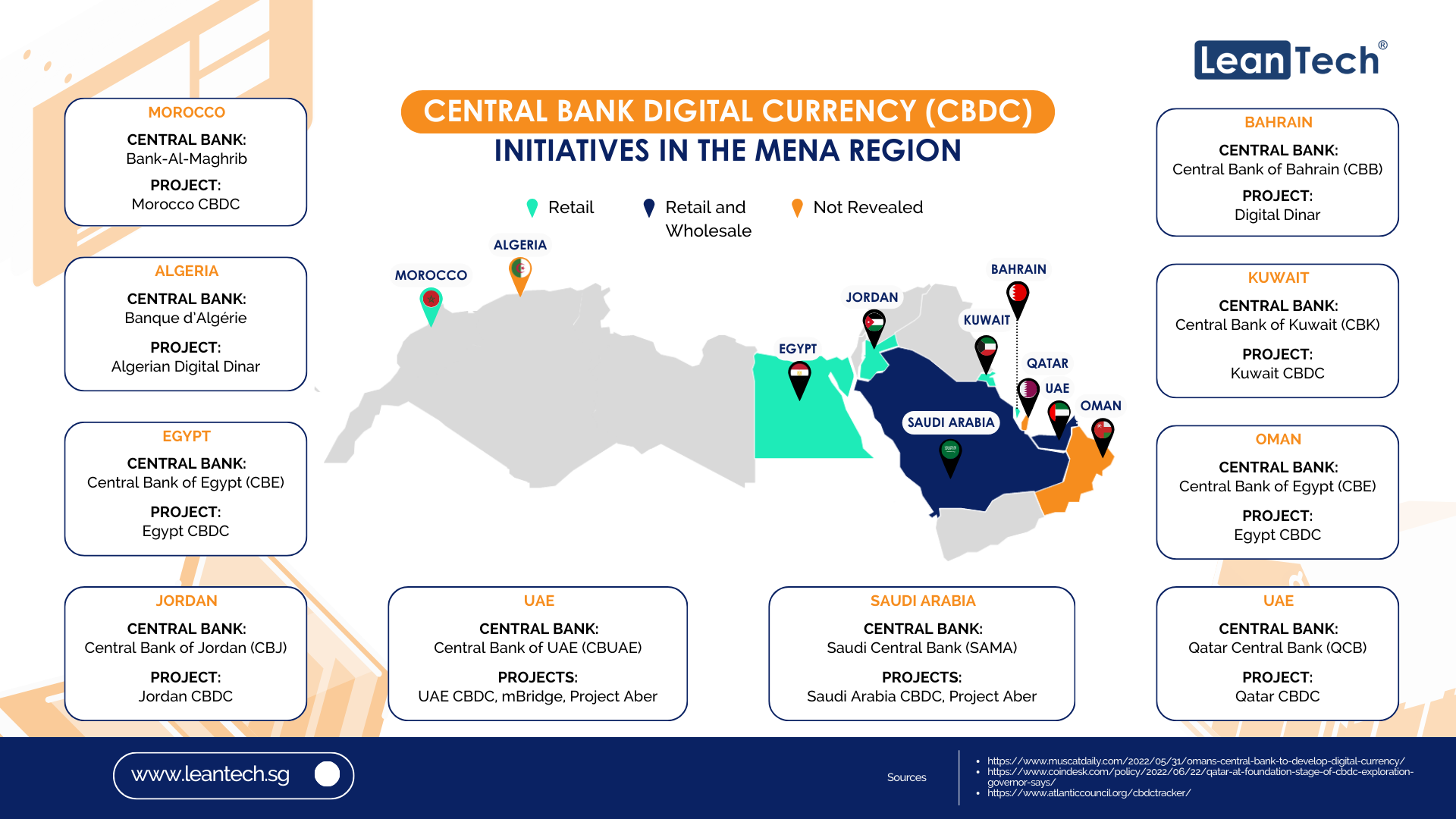

The Middle East and North Africa (MENA) region, home to countries like Algeria, Bahrain, Egypt, Jordan, Kuwait, Morocco, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE), has been witnessing a surge in interest and exploration of Central Bank Digital Currencies (CBDCs). A Central Bank Digital Currency (CBDC) is a form of digital currency issued and regulated by a country’s central bank. Unlike cryptocurrencies such as Bitcoin, CBDCs are considered legal tender, representing the official currency of a nation. They leverage the advantages of blockchain or distributed ledger technology to provide a secure and efficient medium of exchange.

CBDCs offer a digital representation of a country’s fiat currency, combining the familiarity of traditional currency with the benefits of digital transactions. The introduction of CBDCs by central banks is driven by various factors, including the desire to modernise financial systems, enhance payment efficiency, and respond to the changing landscape of global finance. CBDCs typically come in two primary types: retail, designed for public use to streamline everyday transactions, and wholesale, tailored for financial institutions to facilitate interbank transactions and settlement.

In MENA, there is a prevalent focus on retail CBDC projects across the region. This inclination suggests a shared interest in leveraging CBDCs to facilitate easier and more efficient financial transactions for the general public. A common thread among the motivations for launching CBDC projects is the desire to evaluate the impact of digital currencies on the economy. This shared objective implies that central banks are actively assessing how CBDCs could be integrated into their economic frameworks to yield favourable outcomes.

MENA CBDC Status

The landscape of Central Bank Digital Currencies (CBDCs) in the Middle East and North Africa (MENA) region is rapidly evolving, with various central banks spearheading innovative projects. Some even more than one. Each initiative reflects a strategic approach to harnessing the benefits of digital currencies in the modern financial landscape. In November 2020, the Saudi Arabian Monetary Authority (SAMA) took a momentous step forward with the completion of the “Aber” pilot project, a wholesale CBDC developed in collaboration with the Central Bank of the United Arab Emirates (CBUAE). Named after the Arabic word for “crossing,” Aber aimed to evaluate the feasibility and advantages of using a CBDC for cross-border payments. The collaboration not only identified potential challenges but also highlighted the positive outcomes, including faster transaction times, reduced costs, and enhanced transparency and security.

Following suit, the Central Bank of Bahrain unveiled a strategic collaboration in May 2021, focusing on digital currency settlement with Bank ABC and JP Morgan. The successful test conducted in January 2022 using J.P. Morgan’s JPM Coin System paved the way for real-time payments, benefiting entities such as Aluminium Bahrain (ALBA) and its counterparts in the United States.

In October 2022, the Central Bank of the UAE (CBUAE), through Project mBridge, achieved a groundbreaking milestone by completing the first and largest-scale central bank digital currency pilot. This ambitious collaboration involved key players from the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China, and the Bank for International Settlements (BIS). The project showcased the potential for quicker, cost-effective, and secure cross-border monetary settlements using central bank money, aligning with the recognised G20 economic priority. Notably, CBUAE expanded its global collaboration by entering into a Memorandum of Understanding (MoU) with the Reserve Bank of India, focusing on various emerging fintech areas, particularly CBDC cross-border transactions.

March 2023 marked yet another significant stride for the CBUAE, as it implemented a domestic CBDC covering both wholesale and retail segments. This forward-looking move involved strategic partnerships, with Abu Dhabi’s G42 Cloud and R3 serving as infrastructure and technology providers, respectively. The commitment to cutting-edge technologies underscores the Central Bank of the UAE’s dedication to advancing its digital currency initiatives.

These developments collectively illustrate the dynamic and collaborative efforts of MENA region central banks in exploring the vast potential of CBDCs. As these initiatives progress, they are poised to redefine cross-border payments, enhance financial transparency, and contribute to the broader global discourse on the future of digital currencies.

Looking Ahead

While the interest is palpable, the majority of countries in MENA are still in the nascent stages of exploration and research. As these CBDC projects evolve, it will be intriguing to witness how each country navigates the intricate landscape of digital currencies, potentially reshaping the future of finance in the MENA region. The ongoing developments in these countries will undoubtedly contribute to the broader global conversation surrounding the role of CBDCs in the modern financial ecosystem.