Facing a New Horizon of Risk

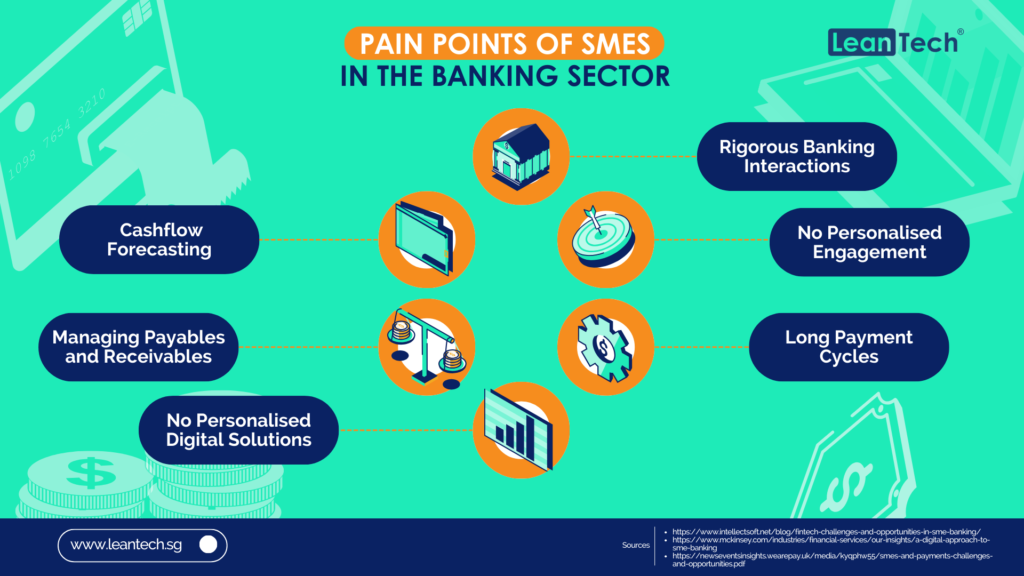

The banking sector across the Gulf Cooperation Council (GCC) stands at a defining moment. With nations diversifying beyond oil and investing heavily in technology and innovation, banks have modernized operations and customer experiences, collectively managing assets worth over $2.5 trillion. Yet, this digital leap has widened the attack surface for sophisticated cyber adversaries.

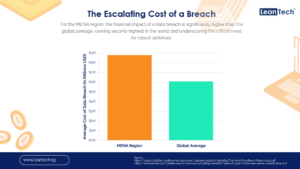

The risks are no longer abstract. In 2024, financial services bore the highest global cost of data breaches at $6.08 million per incident, while in the MENA region, the figure soared to $8.8 million — the second-highest globally. A UAE report revealed that 21% of cyber incidents targeted banks, and ransomware attacks jumped 32% in one year. With the cybercrime economy expected to cost $10.5 trillion annually by 2025, the GCC’s economic ambitions are inseparable from its cybersecurity preparedness.

When Success Breeds Vulnerability

Ironically, the strength of GCC banking is the source of its greatest challenge. Years of digital investment ensured business continuity during the COVID-19 pandemic — a triumph of resilience. But these very systems now attract organized cybercrime groups and even state-backed actors.

The launch of initiatives like Mastercard’s Center for Advanced AI and Cyber Technology in Dubai shows how seriously the region takes the shifting threat landscape, making cybersecurity central to both national and corporate agendas.

The Strategic Integration of Technology

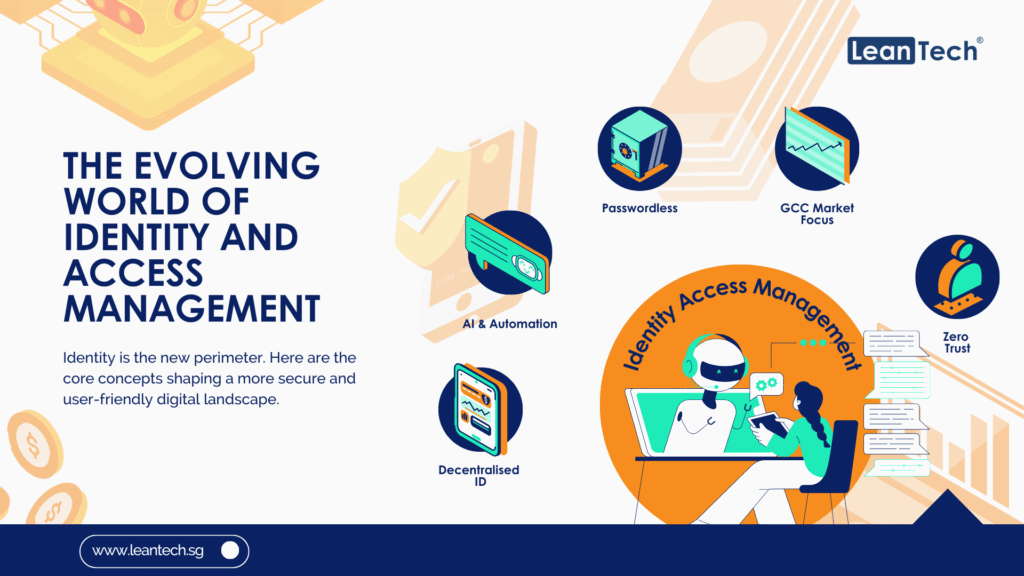

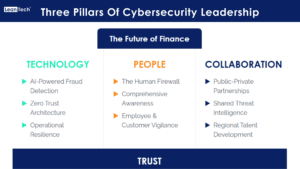

Leaders across the GCC are not just reacting; they are re-engineering their defenses. Two pillars define this evolution: AI-powered security and the Zero Trust framework. AI adoption is already proving its value. Mastercard’s Brighterion safeguards over 60,000 merchants with real-time monitoring, while HSBC cut false positives by 20%, saving $30 million annually. Yet, as defenders use AI to spot threats, attackers are using it to craft smarter attacks.

Zero Trust — the principle of “never trust, always verify” — requires every user, device, and application to undergo continuous checks. Supported by identity and access management, microsegmentation, and least-privilege access, Zero Trust eliminates blind spots that traditional perimeter defenses once had.

When combined, AI and Zero Trust create an intelligent, adaptive system capable of spotting anomalies in real time — moving security from reactive to predictive.

Beyond a Single Institution

No bank can fight cybercrime alone. Just as adversaries collaborate, banks must build collective defenses.

Case in point: Bahrain Islamic Bank’s CISO, Mohammed Isa Hammad, earned ISACA’s Most Innovative Solution Award for cross-sector collaborations with regulators and financial institutions.

Regional hubs: Mastercard’s AI and Cyber Technology Center, launched with the UAE’s AI Office, reflects the growing role of public-private partnerships.

Shared platforms: Events like GISEC Global unite tech giants (Microsoft, Google Cloud, Deloitte) and banks to share intelligence and innovation.

This shift from competitive silos to cooperative defense marks a profound cultural change in the GCC banking ecosystem.

Closing the Talent Gap

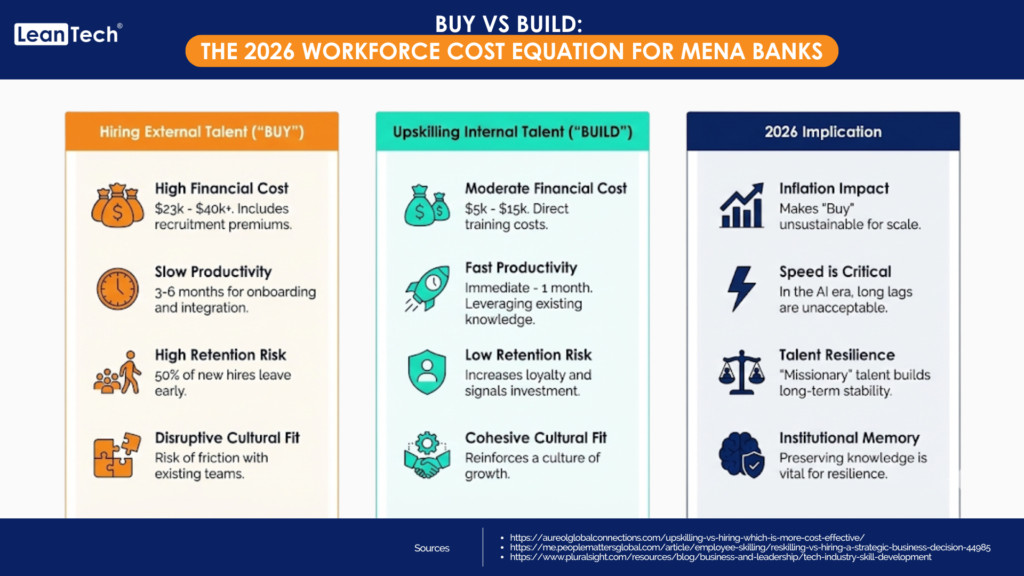

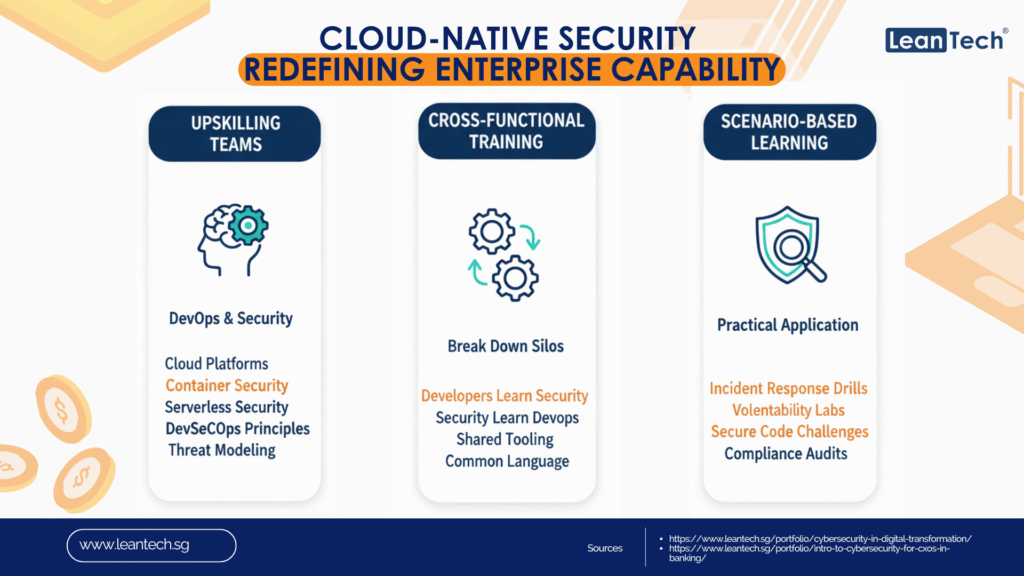

A secure future requires skilled people as much as advanced technology. Yet, a shortage of cybersecurity professionals remains a serious challenge, compounded by higher salaries in the tech sector.

To address this, banks are investing in local talent pipelines:

Regional startups are expanding cyber programs to nurture local expertise. For financial leaders looking to strengthen their teams, tailored training programs such as Cybersecurity in Digital Transformation by LeanTech SG provide practical frameworks to build resilience at scale.

The Ultimate Differentiator: Trust

Ultimately, cybersecurity leadership in GCC banking rests on one word: trust. Technology ensures safe transactions and shields sensitive data. People — employees and customers — are empowered through awareness programs to act as the first line of defense.

Collaboration ensures that no institution faces the threat alone.

Trust is no longer a by-product of good banking. It is the currency customers value most. In a world where financial services can feel commoditized, GCC banks are showing that their edge lies in protecting not just wealth, but peace of mind.

For the GCC banking sector, cybersecurity is no longer merely a cost center or a compliance checkbox. It is a strategic investment in reputation and a cornerstone of the digital economy’s future.

Quick Summary Q&A

What is cyber security in banking?

It is the practice of safeguarding digital systems, transactions, and customer data from cyber threats.

What cyber security do banks use?

Banks rely on layered defenses like firewalls, encryption, AI fraud detection, and Zero Trust frameworks.

What are the different types of cyber security?

Key categories include network security, cloud security, endpoint protection, data security, and identity management.

What is the role of leaders in cyber security?

Leaders set strategy, invest in talent and technology, and build a culture of trust and collaboration.