The GCC payments ecosystem has moved beyond digitisation into a phase of structural consolidation and platform dominance. By 2026, payments in the region are defined less by individual products and more by control of layers across wallets, credit, infrastructure, and national rails.

Countries such as Saudi Arabia and the United Arab Emirates now operate some of the most advanced payment ecosystems globally, combining regulatory coordination with rapid fintech execution. What emerges is a uniquely GCC model where state-backed infrastructure and private innovation coexist tightly.

This article examines how ownership is distributed across the GCC payments stack and why this structure matters for banks, fintechs, and large enterprises.

The GCC Payments Stack Explained

1. Digital Wallets: Ownership of the Consumer Interface

Digital wallets represent the primary consumer touchpoint for everyday payments. Unlike Western markets dominated by Big Tech, GCC wallets are largely bank-led or telco-led, closely integrated with national payment schemes.

Wallets are no longer standalone payment tools. They increasingly bundle P2P transfers, merchant payments, bill settlement, loyalty, and government services.

Strategic implication: Ownership of the wallet layer translates into ownership of transaction data, behavioural insights, and customer engagement frequency.

2. BNPL: Credit Embedded Into Commerce

Buy Now, Pay Later has become a structural component of retail payments rather than a niche financing option. In the GCC, BNPL operates at the intersection of payments, credit underwriting, and merchant acquisition.

Regulators across the region are formalising BNPL frameworks, signalling that deferred payments are now considered part of the mainstream credit system.

Strategic implication: BNPL is less about instalments and more about real-time credit decisioning embedded at checkout, shifting power towards platforms that can manage risk, compliance, and merchant economics simultaneously.

3. Payment Gateways: Invisible but Decisive

Payment gateways form the core commerce enablement layer, determining how merchants connect to cards, wallets, and alternative payment methods.

In the GCC, gateway markets show a mix of domestic consolidation and selective international participation. Increasingly, gateways differentiate through fraud management, reconciliation automation, and API reliability rather than price alone.

Strategic implication: Gateways are evolving from utility services into strategic infrastructure platforms with long-term merchant lock-in.

4. Remittances and Exchange Houses: Cross-Border Liquidity Control

Given the GCC’s expatriate population, remittances remain a foundational payments use case. While traditional exchange houses still dominate volumes, digital remittance channels are reshaping settlement speed, transparency, and pricing.

Strategic implication: Cross-border payments are shifting toward API-driven, near-real-time settlement models, reducing dependency on cash-heavy operations.

5. POS Platforms: The Offline Payments Engine

Despite rapid digital adoption, physical retail remains critical across GCC economies. POS platforms increasingly function as merchant operating systems, integrating inventory, payments, analytics, and financing.

Banks and acquirers now view POS deployment as a strategic lever for SME acquisition rather than a cost centre.

6. National Payment Infrastructure: The Power Layer

National payment rails form the non-negotiable backbone of the GCC payments ecosystem. These systems ensure interoperability, real-time settlement, and regulatory oversight.

By reducing reliance on international card networks for domestic payments, national rails improve resilience, lower costs, and accelerate innovation at the application layer.

Strategic implication: Control of national infrastructure determines payment velocity, systemic stability, and long-term platform sovereignty.

The GCC Model: What Makes It Distinct

The GCC payments landscape stands out globally due to three characteristics:

-

State-backed infrastructure with private-sector execution

-

Rapid regulatory alignment across innovation cycles

-

High consumer trust in digital financial systems

As a result, payments innovation in the GCC tends to scale faster and integrate deeper into everyday economic activity than in many mature markets.

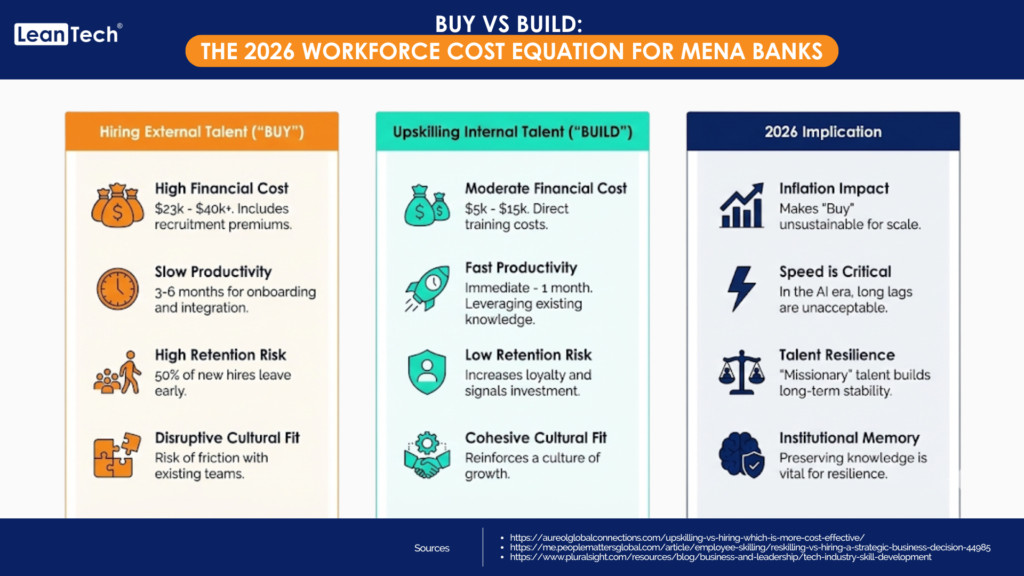

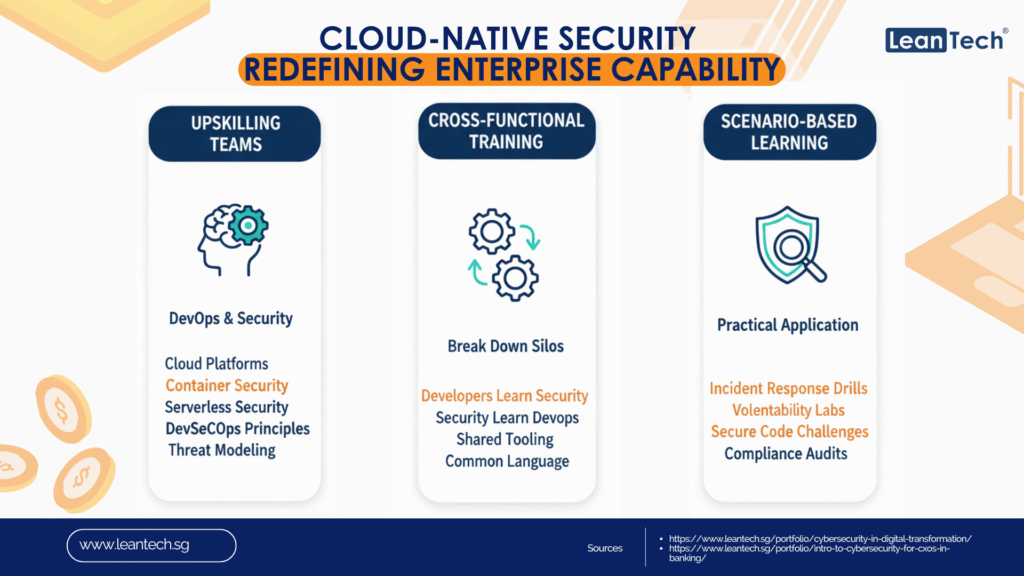

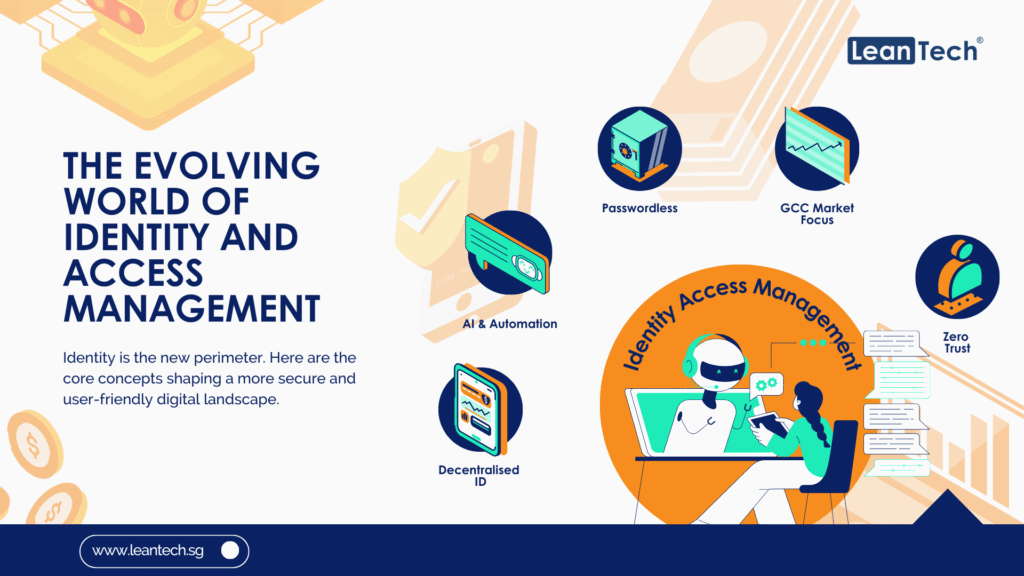

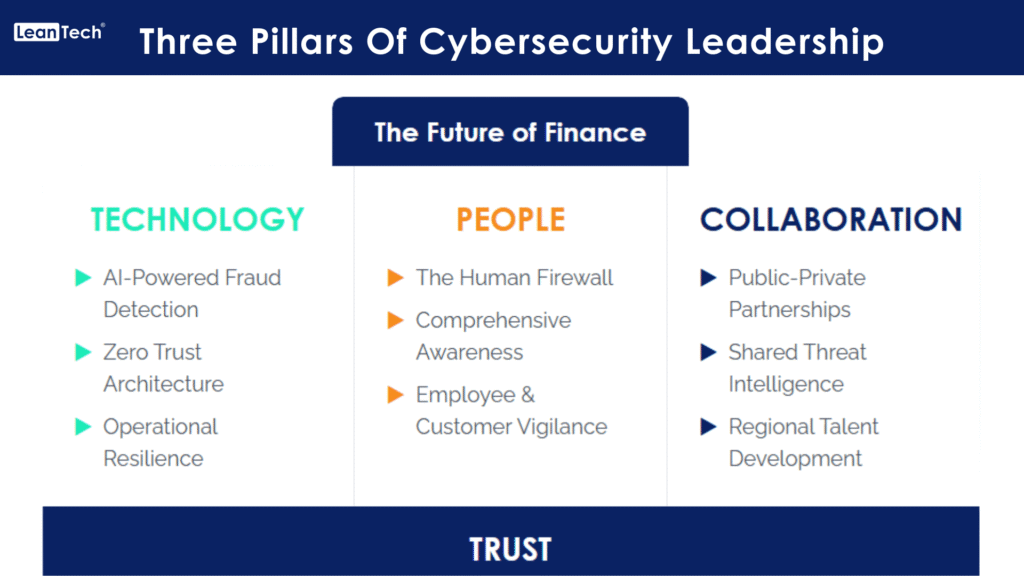

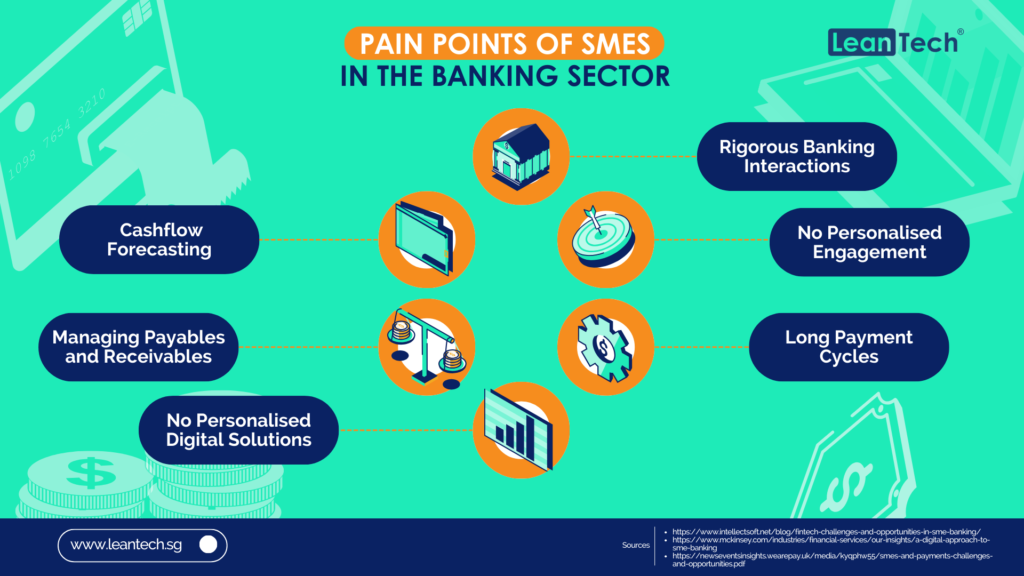

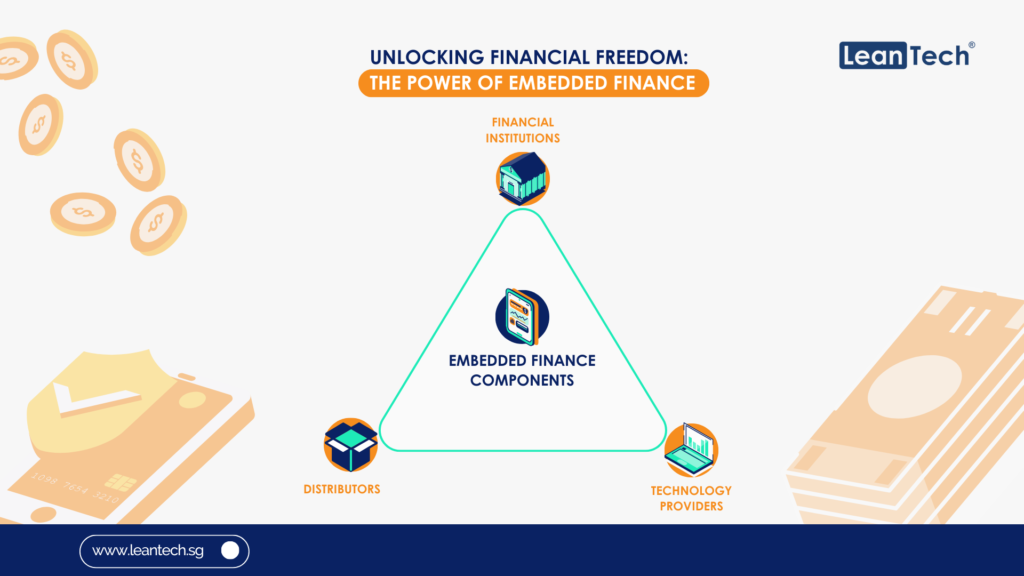

This complexity has also increased demand for structured capability building across digital banking, payments architecture, and platform strategy, areas addressed within professional programs offered by organizations such as LeanTech, which focus on practical, enterprise-grade transformation rather than product-level training.

Key Pointers

What is GCC payment?

Payments systems and services operating across GCC countries, covering wallets, BNPL, gateways, POS, remittances, and national infrastructure.

What is the 4 payment model?

The four-corner model involving issuer bank, acquirer bank, card network, and merchant in a payment transaction.

What are the 4 main financial markets?

Money markets, capital markets, foreign exchange markets, and derivatives markets.

Where does GCC stand in digital banking?

The GCC is among the world’s fastest-advancing regions in digital banking, driven by real-time payments, regulatory coordination, and high consumer adoption.